Patients with the most serious form of a certain inherited disease have skin that is susceptible to wounds, some that you never fill. For years, the only treatment was support, including labor and frequent changes of the dressings for wounds that cover much of the body. Biotechnology research in this disease, bulossic epidermolysis (EB), has followed therapeutic options. The FDA now approves a personalized treatment that the therapeutics of a patient’s skin cells themselves, marking the third approval of the agencies in this rare disorder in the last two years.

The regulatory decision announced on Tuesday covers the treatment of wounds in adults and children who have recessive distributing epidermolysis (RDEB). The therapy, known in development as premedagene zamikeracel, or PZ-CEL to abbreviate, will be marketed under the Zevaskyn brand. Abeona, based in Cleveland, hopes that Zevaskyn becomes greedy in the third quarter of this year.

“We have heard from the RDEB community that there is a persistent and unsatisfied need to heal significant RDEB wounds, especially those that are chronic and prone to infection,” said CEO Vishwas Seshdari a Conference of the Conservation Conference. “Through a single application, Zevaskyn can provide RDEB people with the opportunity for a significant wound closure and pain reduction even in the most serious injuries.”

The Bullosa epidermolysis is falling by mutations to the col7a1 gene, which encodes the type VII collagen that constitutes the anchor proteins that connect the dermis and the epidermis. Without these anchor proteins, the skin is susceptible to blisters and wounds. Those born with EB are sometimes called “butterfly children” because their skin is thin and fragile as wings of a butterfly. In RDEB, the most severe form of EB, both copies of the col7a1 gene are mutated.

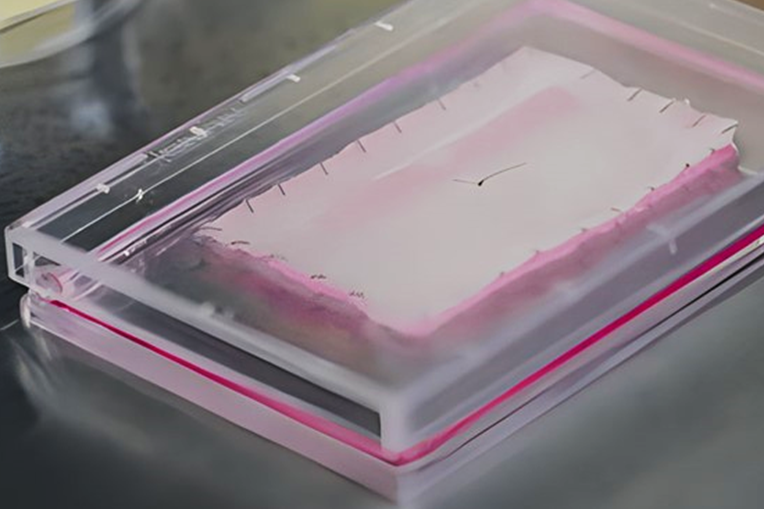

Cell therapy first reached the market as highly personalized cancer treatments carried out by the engineering of the patient’s immune cells. Similar to these autologous therapies, the patient is the starting point for Zevaskyn. The biopsied skin cells of a patient are genetically designed to express functional collagen, said Commercial Director and Commercial Development Head Madhav Vasanthavada. In a 25 -day manufacturing process at Abeona Cleveland facilities, cells become leaves for the size of a credit card. A single biopsy produces up to 12 leaves. Manufactured leaves, which have a useful life of 84 hours, are delivered to a qualified treatment center for surgical application to the patient.

Zevaskyn was evaluated in a phase 3 clinical trial that registered 11 patients with great chronic wounds who had remained open for 6.2 years and, in some cases, were open for 21 years. For each patient, a large wound was treated (approximately 20 square centimeters in size) with Zevaskyn and compared with the site of the wound not treated by a comparable size patient. The main objective was to measure wound healing and pain at six months. Therapy with these objectives. With up to eight years of follow -up, Abeona has reported that patients continue to show the lasting healing of the wound and pain reduction.

As for security and tolerability, the most common adverke reactions reported in the studies were procedure and itching pain. But one of the risks of any therapy performed by genetically engineering of a cell is oncogenesis insertion, the insertion of genetic payload in or near a gene that can cause cancer. Seshdari said that until now there have been no complications related to treatment, including cancer cases.

About a year ago, the FDA rejected Downa’s submission to Zevaskyn, citing the need for more information about the manufacture of therapy. Last November, the FDA accepted Abeona’s forwarding and established an objective date of April 29, 2025 for a regulatory decision.

Abeona estimates that there are about 1,500 American patients eligible for Zevaskyn. Patients will be treated in qualified hospitals that already have experience with patients with EB. Vasanthavada said that Abeona aims to activate five of these sites for the third quarter of this year. At the end of 2025, Vasanhavada projects 10 to 14 patients will have received treatment.

The wholesale price of Zevaskyn is $ 3.1 million, what Vasanthavada said it takes into account the value that the therapy brings to patients and the health system. Attention to chronic wounds of a single RDEB patient can be so high of $ 1 million annually, he said. Abeona will sacrifice agreements based on results in which a percentage of the cost of Zevaskyn will be forwarded if a patient requires the treatment of a previously treated wound within three years. Vasanthavada said that the initial payer feedback has been encouraging, but refused to provide more details due to ongoing discussions.

The FDA approved the first EB distributing therapy in 2023, a gene therapy of Krystal biotechnology formulated as a topical gel applied to the skin once a week. This therapy, Vyjuvek, gives skin cells as a functional version of the Col7A1 gene to promote normal collagen production. Krystal reported $ 250.5 million in sales for Vyjuvek in 2024.

The FDA in 2023 also approved Filsuvez de Chiesi Group, a topical gel whose main pharmaceutical ingredient is destined to promote wound healing in patients with distribution and EB union reflux. Vasanthavada said that Zevaskyn is possible to be used next to other EB therapies. Payers recognize the unsatisfied need, and in discussions so far they have not said that patients can only have a therapy.

“It seems that a complementary approach seems viable,” said Vasanthavada.

The epidermal leaves of Abeona engineering technology for engineering received a license from Stanford University, which is online to receive a regulatory approval milestone payment, as well as royalties of Zevaskyn sales. At the end of 2024, Abeona reported that its cash position was $ 98.1 million.

The approval of the FDA of Zevaskyn came with a priority review coupon that can be used to accelerate the regulatory approach of another therapy for a rare pediatric disease. But companies grant coupons generally sell them as a non -philuted way to raise money. Seshdari said Abeona plans to sell his coupon, pointing to the $ 150 million that have recently reached sales of vouchers.

Photo of Abeona Therapeutics