With the US Vice President JD Vision visiting India on April 21, New Delhi faces a crucial moment to reassess his commercial approach to Washington. The strong increase in US tariffs on Chinese products has opened rare export opportunities for countries such as India, but has also brought new risks, including commercial deviation, dumping and unpredictable demands in the United States.

In these challenging times, Indian companies and the government must remain focused: identify where you can win, protect what you cannot give up and reform what stops it.

The opportunities

Since January 20, the president of the United States, Trump, has launched a wave of rates. Most countries now face a 10 percent tax until July 8, but Chinese products are much more difficult, with tariffs up to 245 percent.

Today’s American tariffs in China are: 245 percent in syringes, 173 percent on lithium -ion batteries, 169 percent in wool sweaters, 145 percent in toys and puzzles, and 20 percent on laptops.

The acute gap between China and the rest of the world is already restructuring global trade, opening short -term export opportunities for others, including India.

Change in commercial flows

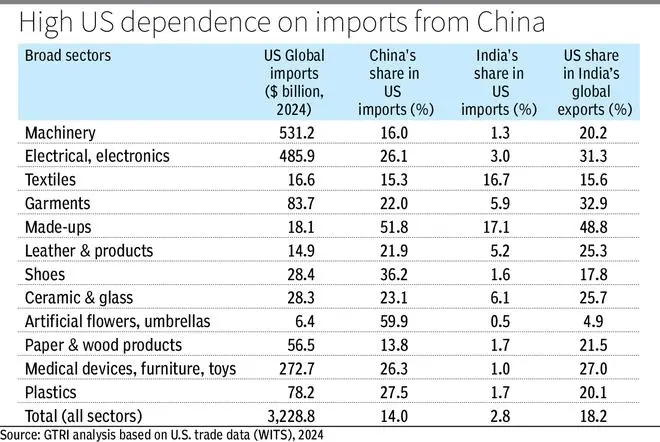

The acute tariff gap is established to alter the flow of goods, especially in the sectors where the US depends largely on China. Electronics will see some of the biggest changes: China supplies 78 percent of US imports of printed circuit plates, LED lights, USB drums and electric transformers. With tariffs on these goods now as a high axis of 245 percent, investors and merchants are actively looking for new supply sources.

This won trade change will be limited to electronics. China also provides 75 percent of US imports of furniture, toys, medical gloves, 67 percent or drills and cooling fans, and 60 percent or footwear. These percentages refer to specific products. For broader categories, see table.

Other specific high -dependence categories include plastic kitchen utensils (80 percent), clothing and bedding (71 percent), screws and hinges (75 percent), aluminum and copper tubes (69 percent), ceramic tiles and glassware (64 percent), pharmaceutical ingredients (72 percent) and even decorative elements such as artificial (86 percent), 86 %).

India: risks, opportunities

As global companies are looking for alternatives, countries such as India, Vietnam and Mexico could see an increase in the demand for new commercial companies or expand existing ones. Three main commercial models are now emerging in response:

Red-Routing or risky goods: Some merchants can try to avoid tariffs by sending Chinese products finished through their countries of origin and revision as local exports to the United States. However, this violates the rules of origin of the United States and could result in severe sanctions. The United States monitors such representation my representation, which makes this a dangerous and unsustainable option.

Dumping of Surplus Chinese Goods: As US imports from China Fall, China can download excessive existences to other countries at lower prices. This increases the risk of discharge, especially in developing markets. The commercial control agency of India, the DGTR, monitors for landfills in low -price imports in all sectors that damage the Indian industry.

New production centers outside China: the most viable model is to establish manufacturing units in India, Vietnam and Mexico. These units will import Chinese components and intermediates, will carry out a substantial local processing and export finished products to the United States and other countries. This legal satisfies the rules of origin and allows companies to benefit from the lowest tariffs.

Sectors such as toys, garments, steel products, engineering products, electronics, furniture, kitchen utensils and auto parts are already seeing interest. Indian companies are receiving consultations from global buyers seeking joint production or subcontracting. As the duration of Trump rates is still uncertain, most companies focus on a rapid and added value assembly instead of deep manufacturing from scratch.

Options before the Indian government

Time is not mature for a large -scale FTA with the USA. Currently, India is the only active country that negotiates a FTA with the Trump administration, an unpredictable partner.

Si bien se les pide a la mayoría de los países que reduzcan las tarifas, India a través del TLC estará bajo presión para aceptar demandas en extensión: abrir su mercado agrícola a los agronegocios de los Estados Unidos, la relajación de los lácteos y el precio de los alimentos de OGM, el alineación, el alineación, el permiso, las restricciones, las restricciones, las restricciones, las restricciones, las restricciones, las Restrictions, restrictions, restrictions, restrictions, restrictions, restrictions, parties, digital fixations, digital rules, rules of digital networks, rules of rules, restrictions, restrictions, restrictions, restrictions, promotions, parties, digital fixations, rules of digital networks, rules, rules, rules, rules, rules, rules, rules, rules, rules, rules Rules, restrictions, rules, networks of networks, rules, the rules of the networks of the United States. and allowing US electronic commerce giants to omit the Indian IED regulations.

Agreeing these long -range demands could permanently damage the food security of India, public health systems, small businesses and digital sovereignty. In the volatile global commercial climate, the blockade in long -term commitments without clarity in the broader commercial direction of the USA. It is risky.

Instead of pursuing a wide FTA, India could sacrifice the US. A rate focused ‘zero for zero’ that eliminate rates duties in 90 percent of industrial goods, while maintaining agriculture and cars outside the table.

Despite government hesitation, ‘zero for zero’ could be a safe and strategic movement. India already grants zero service access to products similar to ASEAN, Japan and South Korea under existing FTAs. Only the EU has proposed a comparable industrial goods pact for the United States. Agricultural trade is still too sensitive to include, so ‘zero for zero’ will also save India to deal with numerous demand in the area of internal policy and restricity to tariffs and commerce.

Industry organisms in engineering, textiles, chemicals and pharmaceutical products support the “zero for zero” approach. Crucially, India must resist the pressure of the United States to reduce car tariffs, which could damage a sector that contributes almost a third of Indian manufacturing GDP. We must remember the collapse of the Australian automotive industry after the tariff cuts in the 1990 national nationals.

Looking beyond us

India should accelerate the TLC conversations with the EU, the United Kingdom and Canada while exploring the strongest economic ties with China, Russia, Japan, South Korea and Asen. Indian officials should avoid political messages that discourage trade with China in favor of the United States.

The next three months will be critical for India. The options made now in response to the movements of aggressive American tariffs could shape the country’s commercial future for years. A careful and strategic approach is vital.

The writer is the founder of Gtri

Posted on April 18, 2025