As Trump tariffs and trade-wars induced volatility impact markets, even fundamental investors may have turned into traders in the last few months; 200 moving day average gained precedence to earnings growth as support levels turned into resistance in a short span. At times of such volatility, long-term investors should stay true to the game and focus on the resources at hand; earnings momentum, valuations and outlook based on the two. We return to basic investing principles to identify sectors, which may have deserved the correction, and those that were harshly punished and provide opportunities.

Pharmaceuticals

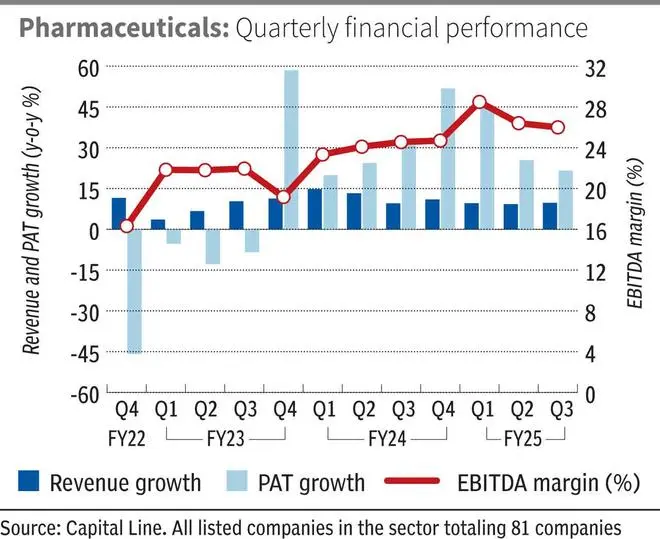

Pharma will be entering FY26 with a strong earnings momentum. The revenue growth has moderated, but is still strong. While India and other emerging markets have contributed to top line growth, the revenue growth has gained from turnaround in the US markets. Efficient asset utilisation, the right geographic mix led by India and branded markets and lower price erosion in the US markets is reflected in EBITDA margins, which are at their highest for the industry, thereby aiding the earnings momentum for the sector.

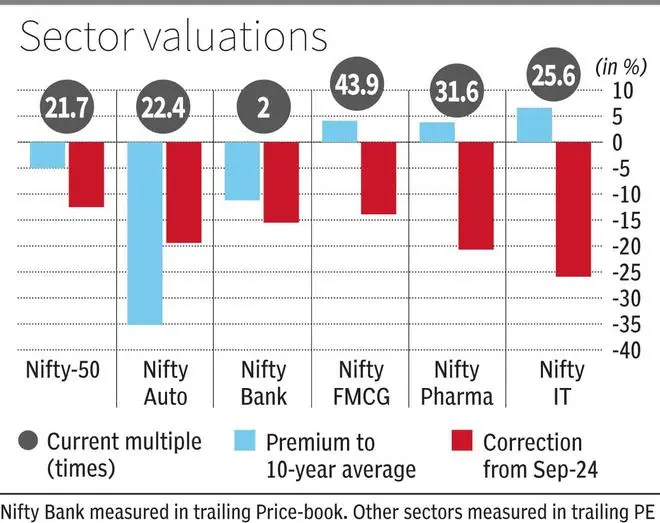

Optimism is well reflected in valuations. The pharma sector is amongst the few sectors with valuations still above last decade’s average, despite a sharp correction from peak.

Outlook

Pharma will have its share of challenges, but the outlook is still positive in our view. Firstly, the headwinds. With close to a third of the revenues from the US markets, the tariff threat is still looming despite a delay/pause. But as detailed in our Big Story, Trump tariffs and Your Stocks in bl. portfolio edition dated March-23, 2025, the impact on domestic pharma will be limited to US capacity replacing Indian generics. The effect will also escalate gradually, based on US capital allocation and hence will take time to play out.

FY26 should be the last full year with generic Revlimid opportunity which has benefitted most of the leading companies in the sector and revenue gap (close to 5-10 per cent of US revenues) will impact companies.

The Indian pharma market’s overall growth has declined in the recent years from 10-11 per cent yearly to high single-digits now. The companies have managed better growth rates by expanding field force, product basket and geographical reach. But the overhang might materialise in slower growth unless combated with new product launches at a faster pace.

The high margins and cyclical peak of US FDA plant approvals are also a key monitorable owing to the potential of impact in case of a higher-than-expected headwind.

The sector opportunities are plentiful too. The US generics pipeline is strong with most companies, excluding Dr. Reddy’s, which does not boast a lucrative portfolio. Aurobindo has a wide specialty product basket to elevate margins, Sun Pharma will further strengthen its specialty tag, Lupin and Cipla have a basket of strong opportunities for the medium-term range. Patent expiry of Semaglutide, the molecule for diabetes to weight loss, will be one another secular opportunity for the segment across India and emerging markets first and regulated markets later.

The leading names have a strong cash balance currently, which will support acquisitions in US specialty or Indian markets further strengthening the product mix.

Divi’s and Suven are amongst the leading names riding the fallout from US Biosecure Act, which makes it imperative to diversify from Chinese contract manufacturing labs. The companies have been engaged in high capex and are witnessing client interest and the impact on bottom-line remains to be seen.

Branded generics markets were led by domestic consumption, but emerging markets are a strong opportunity, and most players are expanding in these segments. This should have a long runway and diversifies the revenue base.

Verdict: The challenges to sector momentum may not have an outsized impact in the medium term owing to several growth levers and broadly-positive geographic opportunities. But with valuations, margins and earnings at a simultaneous peak, investors will have to scan for selective opportunities in the segment or dips to accumulate the stocks.

Automobiles

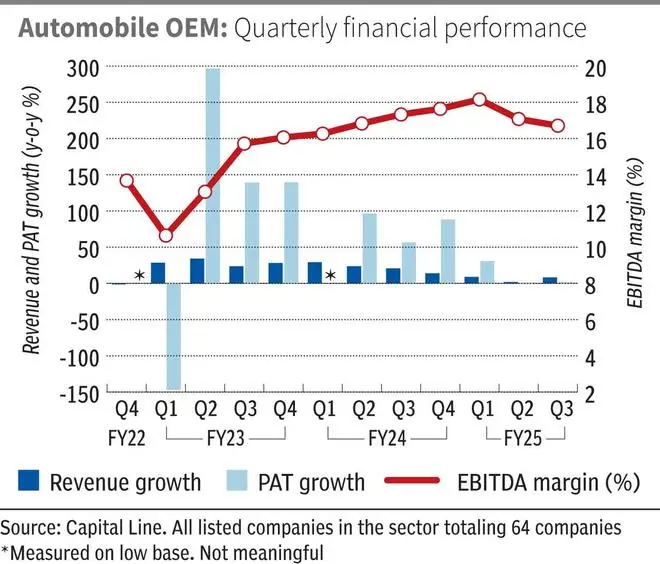

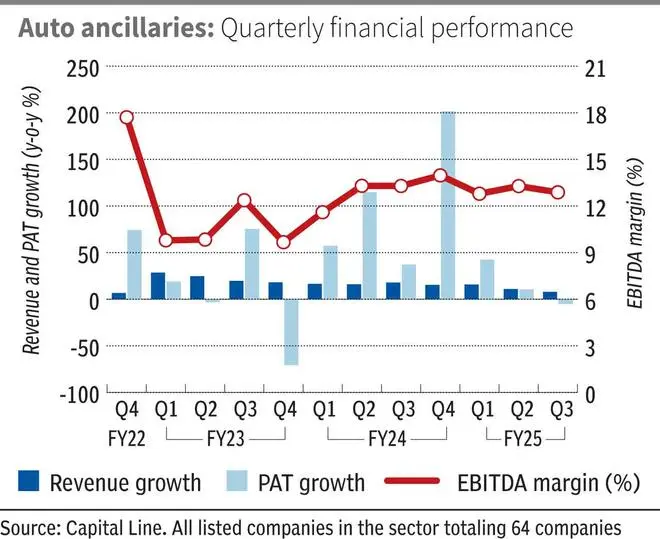

Post the strong upcycle after Covid, the sector will likely consolidate at the upper end by reporting moderate growth. Starting from BS-IV inventory liquidation prior to Covid and then the pandemic, the post-Covid period witnessed strong uptake in the automobile segment. High and pent-up demand on a weakened base made for astronomical growth numbers. The strong operating leverage further magnified the bottom line growth for the industry.

This high-volume growth has started tapering off, but on a high base. With lower scope of operating leverage, the earnings growth will also be normalised in the medium term. This is well reflected in valuations which are 35 per cent below last decade average with tariff uncertainty on auto components further impacting valuations.

Outlook

The four-wheelers have reported strong growth even in Q3FY25 with both Maruti and M&M reporting mid-teens volume growth year on year. The outlook though is predicated on model launches. The segment is currently riding on the SUV sub-segment and EV adoption, both of which support premiumisation of product mix and thereby supporting growth in realisations. Overall, urban-led volume growth moderation can be expected leading to moderation of operating leverage. But price and product-mix led support to margins and softer input commodity costs should offset lower volumes and operating leverage to an extent.

The recovery in rural economy with prospects of better monsoon can support the domestic 2W industry. The segments above entry segment (125 cc and above) and EV model launches are expected to drive growth in both urban and rural markets. The high base of comparison can limit volume growth outlook.

For both the sectors, exports are a bright spot till now but could be impacted by a slowdown in global growth and hence needs to be monitored. With end-markets across Africa, Latin America and West Asia, the impact from diverted Chinese, Asian or European automobiles is lower compared to a general economic slowdown.

The auto ancillary sector, on the other hand, will be under the tariff overhang till resolved. The direct exposure to US markets is varying across companies with Europe, Mexico and Canada being the other markets. But a slowdown in exports to the US will impact the other market growth as well.

Verdict: The sector cannot be overweighted any further in individual portfolios. The valuation comfort must be weighed against growth opportunities in 4W and 2W segment and the correction in auto ancillary cannot be bought into till trade and tariff war issues are resolved.

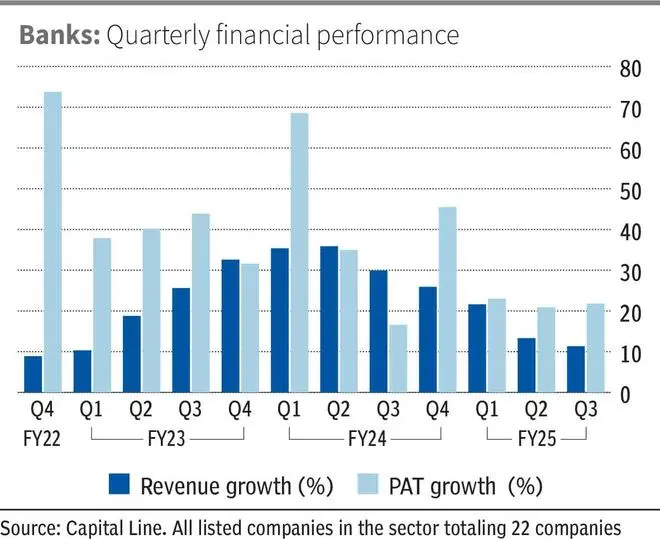

Banks

The banking industry rides into FY26 on a trifecta of positive factors. The credit demand and growth has been strong. The asset quality has been healthy and the net interest margin (NIM) spread was to the advantage of banks. The cost of funds (on deposit/CASA accounts) barely inched up even as yields on loan assets were high. This has aided strong top-and bottom-line growth for banks even as moderation shows up in recent quarters.

The banking sector valuations, which barely inflated in the previous rally, are now 11 per cent below past decade average, having corrected 15 per cent from the peaks.

Outlook

The correction in NIMs has marginally started in the last two quarters. This will further accelerate in the medium term as another rate cut was announced in the meanwhile and the RBI shifted its stance to accommodative to support growth from here on. This amplifies further rate cut expectations, beyond the 50-bps cut so far. The retail and corporate portfolio will seek to reprice their loans in this environment, pressuring bank spreads.

On a high base of credit growth, the growth in advances is still holding up across leading banks. HDFC Bank, looking to bring down loan to deposit ratio after the merger with HDFC, is the exception. Corporate and SME portfolios are also supporting high credit demand, adding to the demand from retail and unsecured ones. The latter has come under marginal duress in earlier quarters, but the effect seems to be contained with tighter underwriting norms (regulatory and internal measures). This should limit credit growth in the unsecured segment.

While MFIs and small finance banks are facing stress, credit quality is holding up well for the large banks. But being linked to macroeconomic cycles, which has run on long legs, investors will have to monitor this head, going forward.

The pressure on NIMs is well anticipated and companies would have levers like MCLR repricing or asset mix to manage the rate cuts. The liquidity easing through open market actions have eased cost of funds and most banks have started reducing deposit rates as well.

Verdict: Despite the NIM pressures, investors can consider the sector owing to valuations below historical average and continued runway in growth. Any resurgence in private capex can support credit growth, but investors will have to prefer banks with an ability to address prime credit customers as the economic cycle is currently at a stage of a cyclical slowdown.

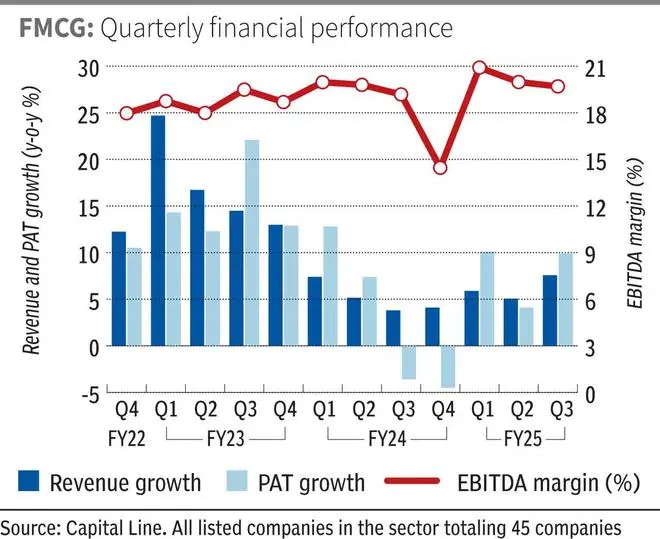

FMCG

The sector has experienced weak revenue and earnings growth in the last two years. The earnings growth has started normalising only in the last three quarters. The weak consumption earlier was limited to the rural segment, but now the commentary extends to urban segments as well, with rural reporting a gradual recovery.

The high input costs, increased competition and reorientation to modern retailers in e-commerce have impacted growth in the last two years. But weak underlying consumption, especially in the entry segment, has been persistent. The sector still trades in line with historical average valuations. From a peak valuation of 50 times in the last year, it has corrected to 43 times now.

Outlook

The sector has a mixed outlook. On one hand, urban demand is bottoming or moderating, and rural demand is gradually seen to be improving (this has been reiterated in commentary by automobile managements as well). The strong monsoons and the recovery in rural wage growth (on a weak base) are aiding a recovery of the rural segment. The urban recovery may hinge on moderating inflation and low-base effects. While the recent tax cuts can benefit big-ticket items such as consumer durables and automobiles, it remains to be seen if FMCG can also benefit from the same.

At the same time, modern retail growth is resilient. This is reiterated by FMCG companies, which report a tailwind for prestige and premium segments from modern commerce. Pricing power seems intact as companies may go for a price hike shortly and so is the drive to premiumisation in FMCG portfolios. Raw material costs are moderating from highs along with crude, which should allow for margin expansion or at least protection.

As stated, the outlook seems mixed for the FMCG sector. The sector reports better pricing ability as inflation moderates, but volume offtake in urban and rural markets is still not out of the woods. The sector reports preference for lower pack sizes and, at the same time, reports a strong growth in premium portfolios.

Verdict: The earlier decade may have supported high multiples as consumption growth was believed to be inevitable. But as the pockets of consumption (premium and entry levels) or the channel of consumption (modern or traditional commerce) are undergoing a shift, the high valuations leave very little room for error. Investors will have to weigh growth opportunities in select consumption segments against valuations in the segment.

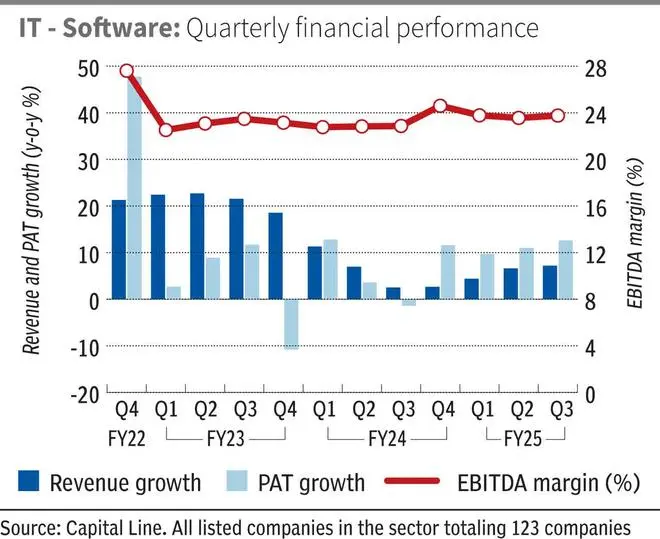

IT

The IT sector did not head into the current fiscal on a strong footing. The revenue growth in INR was in mid-single digits, despite rupee depreciation. The margin improvement from cost control further aided bottom-line growth. Stock prices were buffered from the impact of weak constant currency (CC) growth in H1 of FY25, as a recovery was factored from FY26 with AI, cloud, cost-takeaway projects expected to take off gradually. This allowed valuations to hover above last-decade average despite correcting 26 per cent from peak last year.

However, in the months leading up to now when tariff announcements were flying fast and thick, it was the IT sector that witnessed a sharp correction. This, sometimes, exceeded sectors facing actual tariffs — gems, pharmaceuticals and even auto components. This was due to expectations of a weak global economic activity. With trade barriers being put up, business activity is likely to slow down, which can impact IT spends. This was the expectation going into the results season.

Outlook

The first set of results has supported these expectations of slowdown. Infosys guided for a conservative 0-3 per cent CC growth in FY26, indicating caution stemming from tariff and global growth concerns. TCS also reported tariff impact in retail, auto and travel industry, but healthy demand from BFSI, manufacturing (ex-auto) and others.

Further, a weak FY26 is likely to play out in addition to two back-to-back (FY24 and FY25) underwhelming years for IT services and hence, investor patience may get tested.

Verdict: Between expectation of recovery in business sentiment and caution, investors may side with the latter at the current juncture. The early signs of expanding business activity is still far away before IT budget expansion can come into the picture. IT companies executing current contracts without deal downsizing remain the immediate priority. Global economic concerns apart, IT services will also have to deal with AI-related disruption to its business model. The business growth for large players is near historical lows. While mid-tier IT services companies are reporting better growth, their valuation appears expensive. Investors will have to wait and watch for now as far as the sector is concerned.

Published on April 19, 2025