With the search for intensified defensive bets, the BSE FMCG index has increased 5.3 percent, a little more than twice than the increase of BSE Sensex, such as volatilities that begin from April 2.

And Emami is a slightly differentiated game in this space, with income led by income and the product portfolio that involves Ayurvedic medical care. Fy24 marked the 50 years of company operations and, having increased its operational income, Ebitda and PAT adjusted to a strong cagr or 35 percent, 38 percent and 42 percent, respectively, the FY20-24, EMAMI has achieved stronger outside the layoffs of the dismissal of the companies that arose that arose.

Although the shares have recovered from 19 percent in the last 45 days, the EMAMI has still dropped 26 percent from the maximum of 52 weeks in August 2024. and currently trades its profits for fiscal year 26, it is close to its five -year fodder. Timar compares the same with its closest competitors: Dabur, Marico and Patanjali, trading relatively higher multiples of 41 times, 51 times and 47 times respectively, Emami seeks to have value.

Therefore, investors may consider accumulating in this accountant at current price levels along with other factors below.

The business

Emami has six segments widely: Navratna and Dermicol, pain management, medical attention, boroplus, Kesh King and masculine. It operates under vertical personal care within FMCG.

National businesses contribute at 82-85 percent or their income. Rural markets contribute to 50-55 percent of the national business. Emami’s international business (which covers 70 countries) brings the rest. The Middle East and North Africa Region (MENA) is the largest here, in 45 percent of the export income of the company 9M FY25, compared to 34 percent in the Fiscal Year 2012.

Categorized as a seasonal play before, with the focus on the construction of a portfolio for all climate, the proportion of income derived from non -seasonal brands has improved 56 percent in fiscal year 200, compared to 51 percent in fiscal year 2010.

Segment analysis

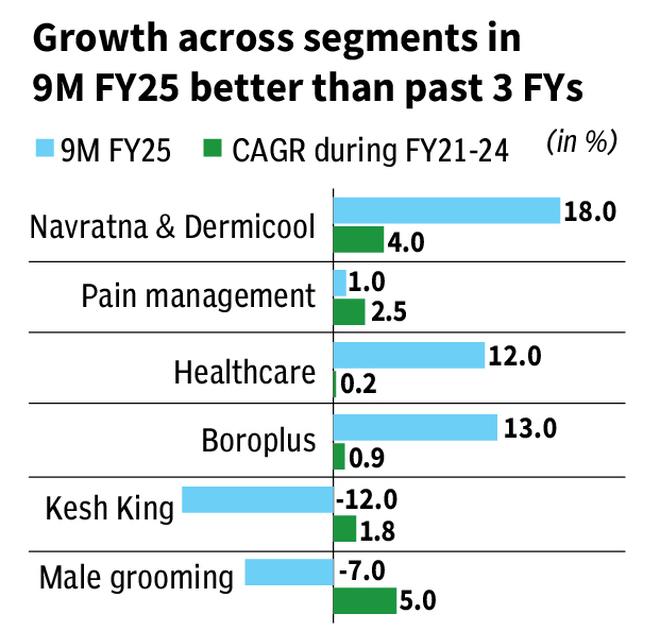

The company does not share data related to the income generated from each segment, but reveals only year -of -year growth rates.

The Navratna and Dermicool range grew the highest, 18 percent year after year, the duration of the 9M FY25 period. The medical care and Boroplus segments followed an impressive 12 percent and 13 percent respectively, all better than their historical TCAG that was in the range of -4.5 percent to 3.5 percent recorded recorded Fy22-24.

The company’s integral portfolio together with the widespread winter helped organize a strong performance duration 9M FY25. Launch of several new products, such as shower, talc and soap gels under the Dermicol brand and better high margin antiseptic cream compensation and boroplus segment lotions worked for the company.

EMAMI’s efforts in the last 18 months to improve visibility and penetration of Ayurvedic products helped the growth of the medical care segment. With Ayurveda’s medicine widely covered by health insurance policies since fiscal year 2015, the health segment is well located.

The two -digit two digit growth was partial by the other segments. The Kesh King range has had a lower yield, with income for a 12 percent duration of 9 m fy25, mainly due to the tepity of the oil segment for added hair. This segment, at the industry level, has had a lower performance with the market leader, Marico, also sees a negative growth in the last 12 months. Emami has hired the BCG management consultants firm to discover strategies to relive the segment.

Pain management segments (1 percent growth) and male toilet (-7 percent) also played loot sport with a deceleration in which growth reduces the general growth of income to 6 percent.

THE ACQUISITION PLAY BOOK

Two D2C personal care brands where Emami began with strategic investments around the science of 2017-18 shine, the specialization in hair and skin care products, and the company Man, which operate in the Premium segment of the male cleaning that offers a wide range, Wiarcote, Wiacare, Wiacare, Waircarte, Fragracare, Cosse Fragrance. Bought in the fiscal year24, becoming total property subsidiaries.

The company is also venturing into drinks with a strategic participation of 26 percent capital in Axiom Ayurveda, which markets drinks under the ‘AloFrut’ brand.

Emami has an acquisition history of scale and approximately 45 percent of its income of the fiscal year24 came from the brands acquired, which confirms the same.

Financial metrics

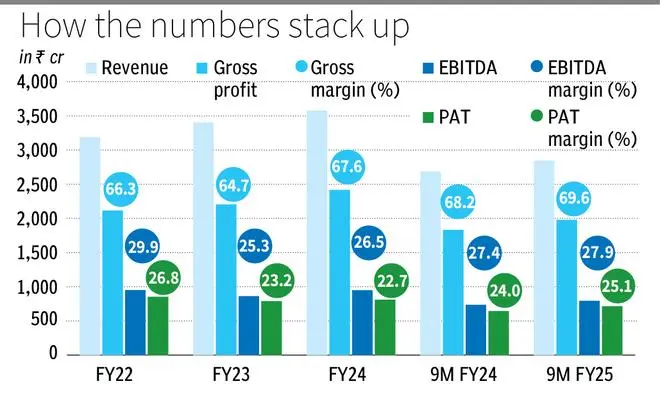

Income for the 9M Fy25 period increased 5.9 percent year after year. National business revenues increased by 7 percent, while the international segment increased by 4 percent (5 percent in CC terms). The volumes for national businesses improved 5 percent rotate the same period. The same number was 2 percent for fiscal year24.

Select price increases, lower packaging material costs and a better combination of products helped with the expansion of the gross margin to 69.6 percent, an increase of 140 bp. The same flowed outside Ebita, which rose 50 bp to 27.9 percent. And Ebitda Grw 7.7 percent of Yoy the same period 9m Fy25, despite a 7 percent increase in advertising and promotion expenses (A&P) and 10.2 percent in employee costs.

PAT adjusted also expanded, online, growing 10.8 percent, thanks to lower interest costs and depreciation.

Growth catalysts

The price increase measures in the previous quarters are expected to support prices growth in 150-200 BPS of the fourth quarter of fiscal year 2015, constantly helping the stability of the profit margin, if not the expansion.

With more than half of the national businesses of rural markets, EMAMI is currently quite isolated against the urban deceleration that affects the industry. The company’s focused initiatives to expand the distribution have also been robust, adding 20,000 cities in rural from the 2011 fiscal year to fiscal year 2014, taking the count to around 52,000, in addition to adding around 39,000 chemicals in the 100 main cities until fiscal year24 and focusing on independent modern retailers.

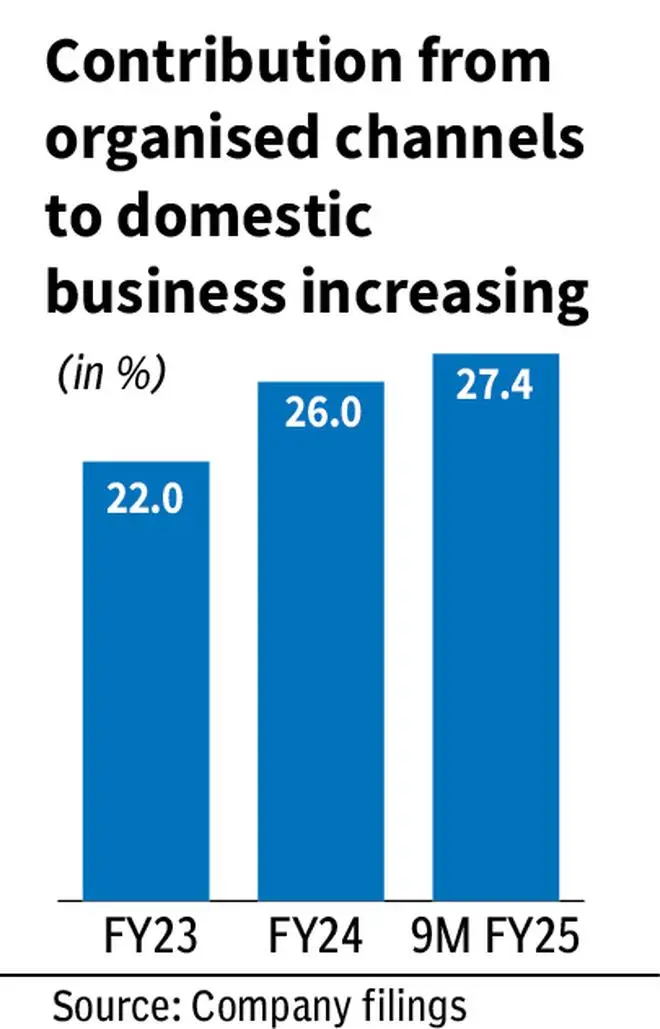

EMAMI’s strategy to focus on different sku for different sales channels also helped increase the contribution of organized channels (which include modern trade, electronic commerce and sales to institutes such as the Department of Song Stores) privalulate in Fent 27.4 in 27.4 in 27.4 is 27.4 to 27.4 to 27.4 is 27.4 It is in 27.4.3.3.3.3.3.

After all, the new product releases of the multipurned growth strategy that are presented (both national and international) focusing on strengthening their main brands, focusing on expanding its distribution network while accounting for the Electronic Commerce Play Book, the Italfisitation Play Book, its cost fisition, its cost physition, its cost physi Costs, its cost, its cost of cost, its cost of cost, its cost of cost, its cost of cost, its cost -cost Fitic, its cost of cost, its cost of cost, its cost of cost, its costs, its cost phyrs, its cost, its cost of cost, its cost. Costfision, its cost physition, measures of Tok Italfo, should work in favor of EMAMI. Despite the urban deceleration and selected low performance segments for the company, the assessment provides comfort and presents a case of accumulation.

Posted on April 19, 2025