I currently have a great option of 550 flames in Berger Paints. I bought by ₹ 4.60 What is the perspective? Should I hold until the expiration? – Akshay Sharma

Berger Paints (₹ 543.60): The action has been in a constant superior trend since the beginning of 2025. It begins to meet after finding support in ₹ 440. But the graph shows that the action has been struggling to obtain resistance in ₹ 550 during the last sessions. A breakdown of this, which probably happens, can raise actions to ₹ 580 and ₹ 600 in the short term.

However, this movement can happen before the expiration of April contracts is very uncertain. And also, remember that futures and options contracts will not be Avia, in Berger Paints as of April 25. Given the thesis factors, we suggest that you leave the premium prevail on open Monday.

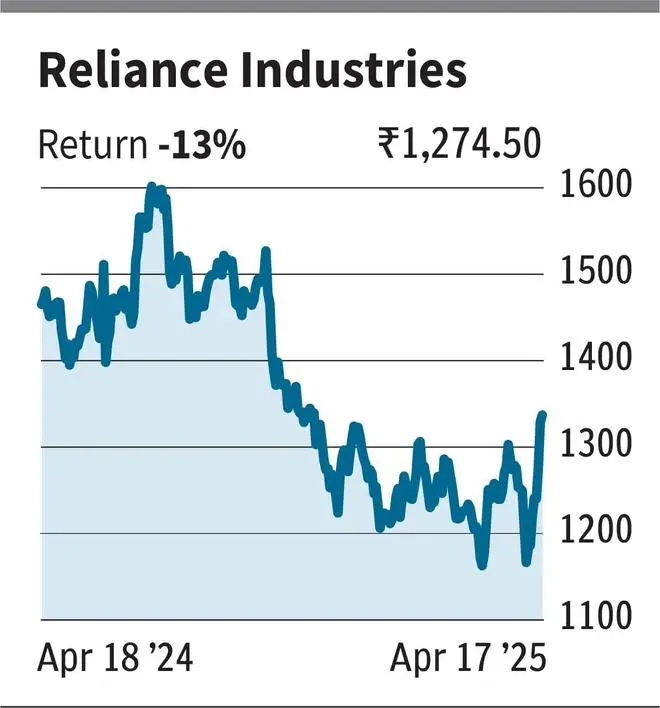

I bought the option to buy Reliance (1400-Strike or can overcome) by ₹ 4. What is the short-term perspective for shares? – Rahul k

Reliance Industries (₹ 1,274.50): Around the last two weeks, the action has seen a strong increase in the price. This suddenly looks stable and there is a good opportunity for the action to extend the rally.

From the current level, the closest remarkable resistance is ₹ 1,320. On the back of this, there may be a minor retirement, probably at ₹ 1,275-1,250. But it is possible, the scrip is expected to leave ₹ 1,320 and appreciate ₹ 1,400 in the short term.

If the action touches ₹ 1,320 in the next two weeks, the 1400 flames of May expiration can increase to ₹ 7.80. A rally to ₹ 1,400 in a month can raise option A ₹ 25 approximately.

As there is a possibility of a lower fall in the price of the shares after it touches ₹ 1,320, we suggest getting out of position when the premium reaches the ₹ 7.50. After this, you can consider buying the option (at the premium on motion) again after the action leaves ₹ 1,320. In this case, you can find an objective or ₹ 25.

Send your queries to derivatives@thehindu.co.in

Posted on April 19, 2025