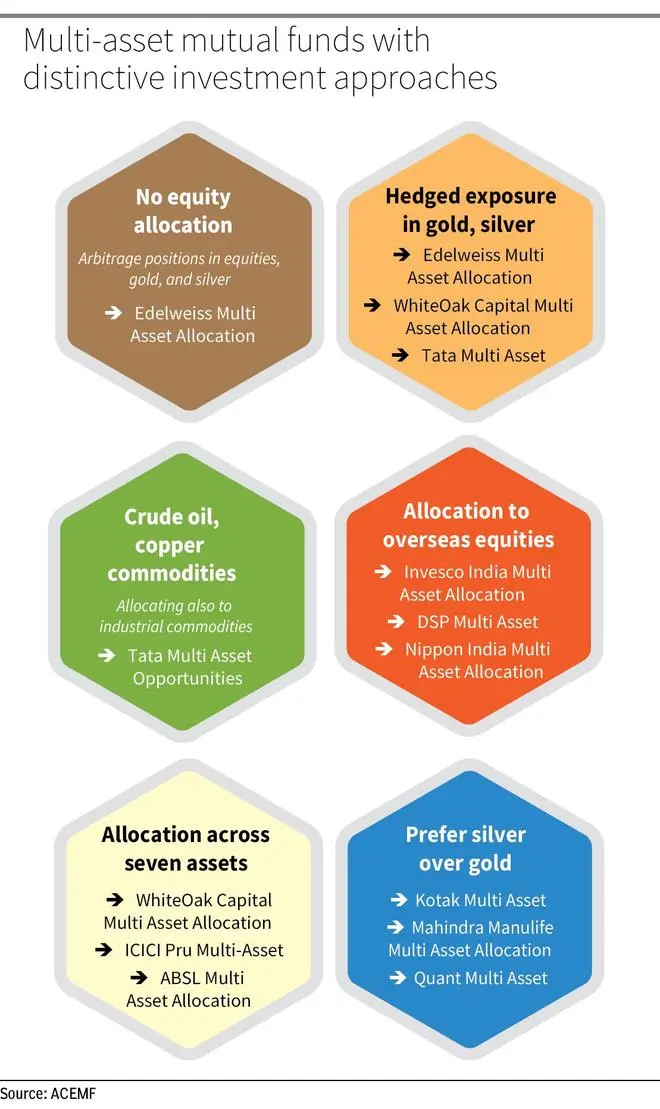

Multiple asset allocation funds (MAAF) have increased in popularity in the last 15-18 months, surpassing many capital and hybrid categories. Currently, 28 funds in this category are aimed at delivering portfolio diversification in asset classes. While the common objective is to balance risk and yields, their investment approaches vary widely in terms of asset allocation and risk profile strategies.

These are some of the variations that investors must take into account:

Without capital allocation

All funds in the category are necessarily assigned to actions without haggling, except the Edelweiss Multiple Assets allocation fund. It is a debt oriented fund that uses arbitration positions in shares, gold and silver along with income of accumulation of fixed income instruments. This fund generates yields similar to debt and arbitration funds. Around the last year, he delivered 8.9 percent, while the arbitration categories and short -term funds recorded an average yield or 7 percent and 9 percent respectively.

Exposure to gold and silver derivatives

While most funds are allocated to ETF of gold or physical gold, funds such as the allocation of multiple assets of Edelweiss, the allocation of multiple assets of Whiteoak capital, ICICI PRU MULTI-OSET and TATA MULTI ASSET OPPORTED BARK. Gold and silver derivatives offer leverage and flexibility with lower capital requirements than ETFs in India. The allocation of multiple Whiteoak capital assets and multiple TATA assets opportunities granted annualized yield or 16 percent and 8 percent in the last year.

Exposure to raw products, copper, zinc and aluminum

Tata Multi Asset Opportunities Fund is unique in the industry by also investing in crude oil, copper, zinc and aluminum through derivatives of basic products in the stock market. It maintains a general allocation of basic products that varies from 10 to 20 percent of the portfolio. ICICI PRU MULTI-ASET has also assigned less than one percent to copper derivatives. This can allow investors to take advantage of profits in these industrial products that may not have direct access. Tata Multi Asset has a five -year history, which offers an average continuous performance of one year or 18 percent from the beginning, with the lowest yield is 1 percent.

Assignment to Equitas abroad

Seven funds in the category are assigned to the actions abroad, adding another layer of diversification. Funds with high assignments abroad include the allocation of multiple assets of India Investco (17 percent), the allocation of multiple DSP assets (15 percent) and the Multiple Assets allocation fund of Nippon India (10 percent). While Investo India Multi Asset is mainly assigned to US actions, the allocation of multiple DSP assets and the assignment of multiple assets of Nippon India offer exposure in global markets. The allocation of Multiple DSP assets and the allocation of multiple assets of Nippon India registered annual yields or 12 percent and 10.5 percent, respectively, during the past year. The allocation of multiple investigations of Investco India, on the other hand, has been in operation for less than a year.

Assignment in seven assets

Three funds provide a well -diversified exhibition by assigning as many assets of assets as permissible for the industry. The assignment of multiple Whiteoak capital assets, the Multiple Assets allocation Fund ICICI PRU MULTI-TI and ADITYA BIRLA SL have invested in seven assets: national actions, arbitration positions, debt, gold, silver, actions of the classifications abroad, young and investments. Among these schemes, Icici PRU Multi-ascet stands out with a long history, since it has delivered annual yields or 25 percent in the last five years.

Heavy and small capitalization heavy portfolio

Some funds focus largely on medium and small capitalization. The three main funds with the highest exposure to this segment are the multiple asset of Oswal Motilal (31 percent), the allocation of multiple assets LIC MF (30 percent) and the Multiple Assets allocation Fund HSBC (27 percent), compared to the category of eternal 15 percent. This can lead to farm yields than for colleagues but with greater volatility and downward risks. This was obvious in its performance that recruited the recent market recession, with Motilal Oswal Multi Asset publishing a negative or 9 percent yield and allocation of HSBC multiple assets that administers only a 4 percent yield in the last year. However, LIC MF Multi Asset Assignment has a history of less than a year.

Greater exposure to equipment without charging

Currently, 16 funds invest at least 65 percent in shares. The Multiple Assets allocation and the Multiple Assets allocation Fund of Sundaram have constantly maintained equity levels while remaining exceeding 65 percent. On the contrary, the Motilal Oswal and Quant Multi Asset asset fund demonstrates dynamic asset allocation practices. The allocation of multiple assets UTI and SLARDAM returned 8 percent and 12 percent annually during the past year.

Silver over gold

Some funds prefer silver over gold. According to the latest portfolio data, the allocation of multiple Kotak assets, the Máhindra Maneulife multiple asset and the quantitative of multiple assets have higher allocations in silver than gold. Silver works more as an industrial product than as a safe port and can add greater volatility along with the performance potential to the portfolio. Around the last year, the allocation of multiple Kotak assets, the Máhindra Manulife Multiple Assets and the Quantial Multifiestal Assets delivered 7 percent, 10 percent and 3 percent respectively.

Posted on April 19, 2025