The persistent drop in markets from September 2024 to March 2025 has finally brought some comfort of the valuations. With large, media and small capitalization rates that had fallen 15-26 percent from the peak, before gathering slowly in recent weeks, PE multiples have fallen into all areas.

However, continuous uncertainties about the United States commercial tariff

Anchoring your portfolio to carefully chosen value names and selections can help express volatility and long -term delivery.

Tata Equity for Fund is a good option for value investors who want to create long-term wealth of 7-10 years.

The Fund invests at least 70 percent of its assets in companies whose laminated relations based on the profits of the last four quarters are lower than the rolling p/e of the BSE Sensex shares.

Tata Equity P/E has a history of almost 21 years and has delivered a healthy coverage performance above this period. Investments can be made through the SIP route to average costs and market volatility.

Proven interpreter

The scheme performance in recent decades has been healthy. He has delivered 18.1 percent composed annually since its inception in June 2024.

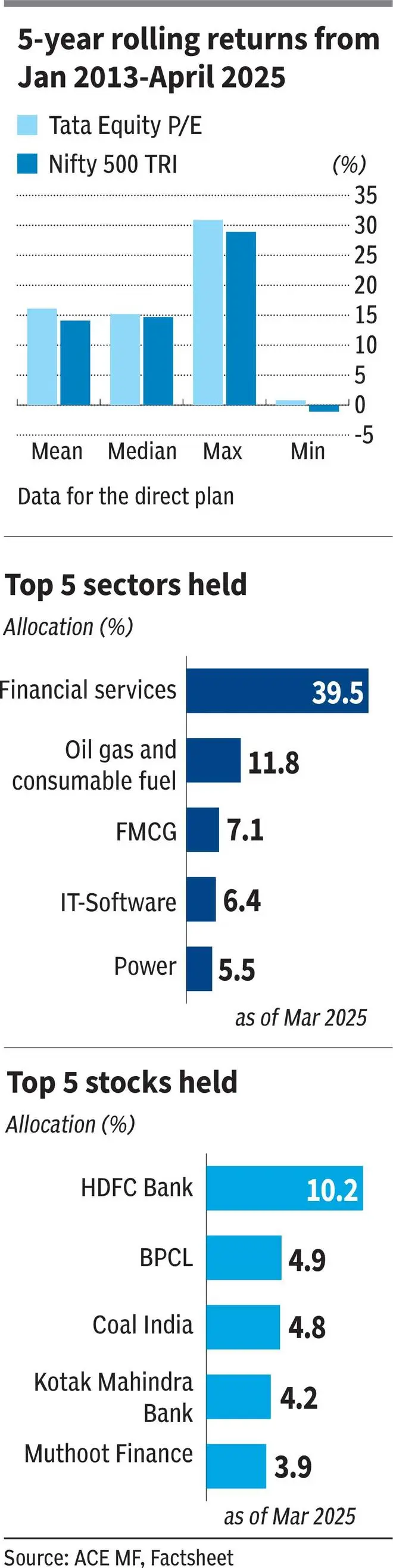

When five -year returns are considered last in January 2013 to April 2025, Tata Equity P/E has delivered average yields or 16.1 percent. Its NIFTY 500 TRI HAS reference administered average or 14.1 percent returns in the same time frame.

In addition, in the 12 -year period mentioned above, in a 5 -year rolling base, the scheme has exceeded its reference almost 69 percent of the time, which is quite robust. It has delivered more than 12 percent almost 68 percent of the time during this period and more than 15 percent more than 51 percent of the time.

The SIP Returns of the Fund (Xirr) in the last 10 years are quite robust in 16.4 percent. A SIP in its Nifty 500 Tri reference would have returned 14.5 percent during the same period.

All return figures refer to the direct plan of the P/E Fund of Tata Equity.

The background has an upward capture ratio or 111.6, indicating that your Nav increases much more than reference duration manifestations. But most importantly, it has a downward capture ratio or 88.4, indicating that the NAV of the scheme falls less than the ingenious corrections of 500 Tri last. A 100 score indicates that a background works in line with its reference point. This is based on April 2022-April 2025.

Smart portfolio rotation

Tata Equity for Fund adopts a FlexiCap approach for the selection of shares. Therefore, there is a substantial proportion invested in middle and small layers, although large layers dominate the wallet. In recent years, the allocation to large CAPS has been a little more than 60 percent of levels. Therefore, medium and small layers represent 30-35 percent of general holdings. As the portfolio is anchored to the assessment, it suffers market corrections of a shorter duration.

The background manages to a well diversified and robust wallet or 35-40 actions without being too concentrated in any name that comes out of the few main holdings.

Cash positions are tasks for only 4-6 percent of the portfolio.

Financial services, mainly banks, NBFC and capital market companies, have always been the main holdings of Tata Equity P/E. Large banks and NBFC have been especially resistant in the recent market correction in the last six months. This has helped the background to stay and not suffer very heavy.

Petroleum, gas and consumable fuels have also been among the main fund holdings over the years, since the valuations remain the comfort zone for companies in the thesis segments.

He took advantage of exposure to automotive cars and components as the segments faced a slowdown and also the uncertainties of the United States commercial rates. The correction in IT stocks has increased the increase in the fund in select spaces. FMCG’s great stocks have also been significantly corrected, which provides value opportunities so that the background increases bets in some chosen names.

The background adheres to the value style and does not look heavy in the stocks driven by the impulse in the small capitalization segment.

For investors willing to remain in the long term and take low performance periods in its passage, Tata Equity for Fund can be a gratifying investment.

Posted on April 19, 2025