Despite the entire talk about the establishment of bilateral trade in local currencies in the last five years, The dollar participation in global reserves has remained stable since 2020 | Photo credit: Lockiecurrie

When the president of the United States, Donald Trump, unleashed his reciprocal tariffs on all nations, asset classes reacted predictably. Equity, bonds and coins witnessed a large sales wave. With the US Treasury bonds. And the US dollar also wobbles under sale, investors seemed to be on a high line for the only sure shelter that was maintaining gold.

The international gold price has increased by 29 percent since the beginning of this calendar, and almost 8 percent higher from the announcement of reciprocal rates in early April. The dollar, on the other hand, has been on a slippery slope. With the walk in the rate, along with the expenses of expenses headed by Doge (Government Efficiency Department), making the United States economy become a recession, investors appear more than the green back; Pull the dollar index 10 percent lower from the beginning of this calendar.

In the midst of this dichotomy in the performance of the dollar and gold, the center of attention also has bones on how global central banks have a prescious bone to anticipate the dollar debacle by increasing their possession of gold reserves and reducing the dollar in dollar. But a look closer to the data reveals the fallacy in this belief.

While it is true that the participation of the dollar in the official foreign exchange reserves is due to the last two decades, this is mainly due to the actions of some central banks, such as Russia and Switzerland. Most countries, including India, have increased their possession of the United States Treasury in this period.

Similarly, the addition of gold to the holdings of the Central Bank is directed mainly by five countries. Most countries have maintained gold reserves at the same level since 2009, and some sell the yellow metal held in their reserves.

Dolk of the dollar

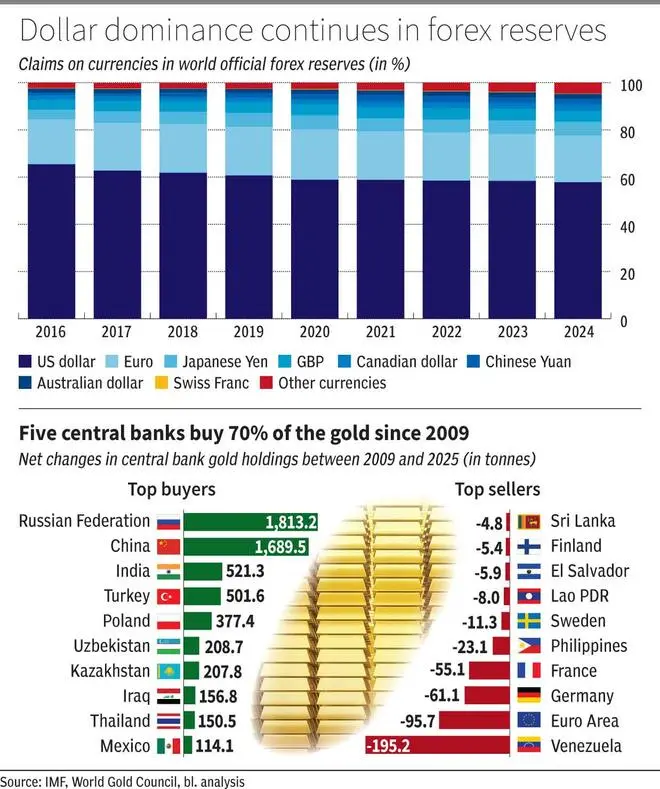

While the participation of the dollar in the official foreign exchange reserves has decreased in the last two decades, it still retains the greatest participation. According to the IMF COFER report, the proportion of the dollar has decreased from more than 70 percent to the early 2000s; But it has a stable leg in about 58 percent in the last five years.

Research shows that the reduction of dollar actions in global reserves is mainly due to the actions of Russia and Switzerland. An IMF blog by Serkan Arslanalp, Barry Eichern and Chima Simpson-Bell points out that “the decrease in the participation of the dollar in the reserves, in fact, reflects the behavior of a handful or large reserve. The accumulated reserves over the last decade, have reasons to have a fraction of their reserves in the euro, the euro area is its geographer and more important neighbor. Using data published by its central banks from 2007 to 2021, there are few changes in the general trend.

This finding is not surprising since most countries are obliged to have dollars. The dollar has a 54 percent participation in the global invocation of exports and 88 percent participation in all global transactions.

Besids this, the great external debt called in US dollars makes it demanding that countries rise dollars. India Hero $ 80.5 billion Treasury bonds of the United States in 2014, which has increased to $ 228 billion for February 2025.

While other currencies may want to challenge the pole pole of the dollar, it is easier to say it than to do it. This is due to the large size of the United States economy, the depth in its financial markets, the convertibility of the capital account and its role as an anchor currency.

While the euro has the second largest participation in Forex’s official world reserves, with 20 percent, this participation has remained stagnant in the last decade. Other currencies have advanced, but their actions are still lowercase. For example, the Chinese Yuan increased its participation of 1.1 percent of world currency reserves in 2016 to 2.2 percent in 2024. Similarly, non -traditional reserve currencies such as Canadian and Australian dollars also have online.

It is also interesting to observe that, despite all conversations about the establishment of bilateral trade in local currencies in the last five years, the participation of the dollar has been stable since 2020.

5 countries turned to gold

Another common discomfort is that all countries are diversifying their gold foreign exchange reserves.

The global central banks became net buyers or gold after the global crisis of 2008. They were only gold vendors stationed for 2002 and 2008; With the central banks of France, Switzerland, Germany and the Netherlands regularly sell gold in this period. The gigantic quantitative relaxation of the United States Federal Reserve, the European Central Bank and the Bank of Japan and the degradation of breathed coins as a result seems to have been the initial trigger.

While it is true that global central banks, together, became net gold buyers between 2009 and 2025, gold purchases were limited only to some central banks. A total of 7,076 tons of gold were added by 162 central banks/state execution company in this period. But half or this purchase came from Russia (1,813 tons) and China (1,689 tons). The five main gold buyers, including Türkiye, India and Poland, represented 70 percent of gold purchases. Of the five main gold buyers, India seems to be trying to diversify their reserves, but you cannot say the same of the ethers, with political compulsions that promote some central banks.

Besids, many countries have decided to maintain their stable gold reserves since 2009, while some had to sell gold to meet the demands. Of the 162 entities that the data has collected the bone by the WGC, 69 did not report changes in their gold holdings and 25 reported a decrease. Venezuela, followed by the euro zone, registered the greatest decreases in gold holdings since 2009.

It is true that countries are exasperated by the policies adopted by the United States and their breach of responsible acting as the owner of the most used reserve currency in the world. But the domain of the dollar in global transactions makes it necessary for central banks to have green support. Therefore, implying when dollar can be very far.

Posted on April 21, 2025