I have shares of Reliance Industries bought to ₹ 1,400. What is the perspective?

Sitara

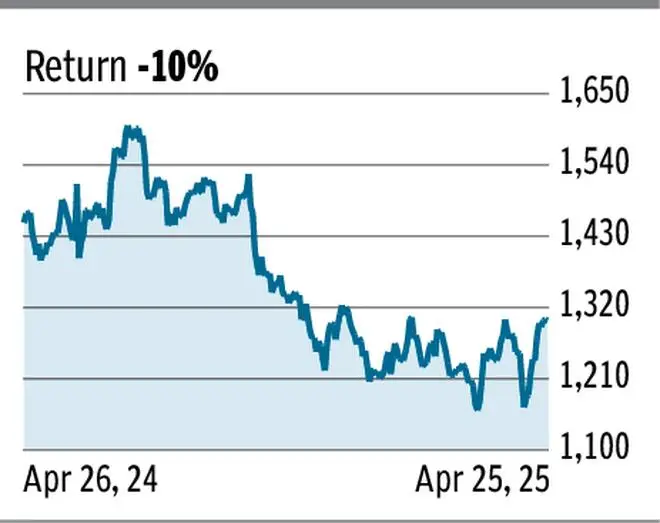

Reliance Industries (₹ 1,300): The long -term perspective is optimistic for Reliance Industries. Strong support is ₹ 1,150-1,100, which remains very good. The resistance is ₹ 1,350. A strong rest above this can carry the price of Reliance Industries A ₹ 2,000 shares in the next four to six quarters. However, the lack of non-compliance with ₹ 1,350 can maintain actions in a range of ₹ 1,100-1,350 for some time.

You can buy more at the current levels. Keep the Stop-Loss in ₹ 1,060. Check the Stop-Loss to ₹ 1,320 when the price rises to ₹ 1,390. Move the stop-loss up to ₹ 1,450 and ₹ 1,650 when the price touches ₹ 1,600 and ₹ 1,900. Leave the actions to ₹ 2,000. This upward view will go badly only if the price decreases below ₹ 1,100. In that case, thought is less likely, the price of shares can fall to ₹ 900-880.

I have actions of Tata Power Company. What is the perspective?

Nagaraj, Nagcoil

Tata Power Company (₹ 387.30): The long -term trend has increased. Within that, the action is in a corrective fall since October of last year. There is space in the inconvenience to see ₹ 300. But a fall beyond ₹ 300 is unlikely. A new Rally leg of about ₹ 300 can carry the price of Tata Power Company shares up to ₹ 600 in a year or two.

As you have not mentioned its purchase price, it is difficult to give a precise advice. However, if you are a long -term investor, buy more at ₹ 340 and ₹ 320. Investors who wish to enter this action can also buy at the previous levels. Keep the Stop-Loss in ₹ 230. Check the stop-loss to ₹ 380 when the price rises to ₹ 450. Move the stop -los to ₹ 450 when the price touches ₹ 530. It leaves the shares to ₹ 600.

What is the perspective of Apollo Micro Systems? Can I buy the shares now?

Swetha, Mumbai

Apollo Micro Systems (₹ 111.65): The stock has been volatile and oscillating in a very wide range for more than a year. The negotiation range has been ₹ 88- ₹ 160 since November 2023. Within this range, the action has now decreased. There are good chans to see a fall at 100 and even 88, the slowest end of the range in the next two months.

A rebound from the ₹ 90-88 region can carry the price of shares up to ₹ 130-150 again. But a break below ₹ 88 will be very Arary. Such a break will see that the price of Apollo Micro Systems actions falls to ₹ 60-50. A sustained break is needed above ₹ 160 to become bullish again. Only then an increase in ₹ 200 will enter the scene. For now, perspectives are mixed, it is better to stay away from this stock.

What is the perspective of the Indian company of Pipe?

Kishor

Indian Hume Pipe Company (₹ 398.85): The action is in a strong bearish trend since September last year. The recently bounces from the minimum of ₹ 283 seems a corrective increase within the wide bassist trend. The level of ₹ 410 is a crucial resistance that must be broken to see a new rally to ₹ 600 again.

While the actions are quoted below ₹ 410, there is a danger of seeing a fall of ₹ 250 in the coming months. In addition, I look at the historical action of the price, the recently Pall looks like the previous trend that occurred from September 2017 to March 2020. Then, if the story is repeated, then it is a great danger that the Indian Pepa Hume-TWW-Precium falls. Therefore, it is better to stay out of this action for now.

Send your questions to techtrail@thehindu.co.in

Posted on April 26, 2025