The adjustment of credit subscription standards on unbelief loans in the midst of strict liquuidity conditions in the fourth quarter, also led to the deceleration of the growth of retail loans, according to experts. | Photo credit: Dhiraj Singh

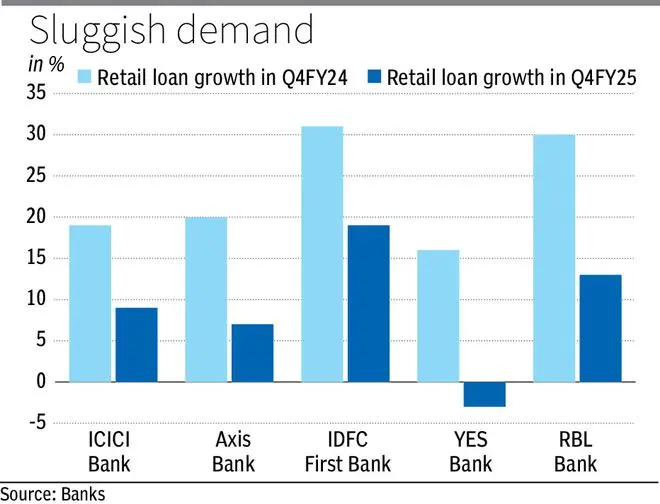

Large and medium banks have registered a strong drop in the rhythm of the growth of retail loans in the fourth quarter of 2015, usually seen as the most occupied financial quarter for business growth, due to the problems of lower demand and pricing for prices for home and vehicles. The adjustment of credit subscription standards on unbelief loans in the midst of strict liquuidity conditions in the fourth quarter, also led to the deceleration of the growth of retail loans, according to experts.

Sandep Batra, ED in Icici Bank, says that the loan growth of the lender has been slowed mainly in the unidentified segment. “Our approach has been more a growth calibrated by risk. And, of course, during this period, we have seen intense competition in the price of mortgages and corporate loans. Given the expectation of imminent tariff cuts, we focus on the appropriate propagation on our reference points during the quarter, and we focus more on sustainable profitability,” he said.

Arjun Chowdhry, group executive – retail loans, NRI, payments and banks rich in Axis Bank, said the lender has been calibrating the growth of the different segments of retail assets. “As we see the first improvement firms in this regard, we will open the acquisitions in retail assets. Specifically, we had tasks some actions for means/calibrate the originations in the insecure book, and we are seeing well the first positive and prolonged itet itet and the prolonged loans of the loans and vehicles of the vehicles of the steps of the steps of last year.

“It is a combination of factors. There is a bit of macro and a little because of the banks,” he said.

Growth pain

Retail loans from the private sector Icici Bank grew at a rate or 9 percent year -on -year (interannual) in q4fy25 to ₹ 7.17 Lakh million rupees, significant lower than the growth of 19 percent observed in Q4Fy24. Mortgage loans, which constitute most of the retail loan book, grew by 11 percent in Q4Fy25, while vehicle loans and personal loans grew 4 percent each, loans with credit cards increased by 12 percent, loans against shares and others.

Similarly, Axis Bank’s retail loans Grew at A RATE OR 7 PER CENT IN Q4FY25, COMPARTED TO 20 PER CENTES Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Grans Gran Gran, while Laans Grans Grans Grans Grans Grans Grans Grans Grans, while, while Laain focuses, while thean occ That Laans Grans Grans, the last growth is seen.

The medium YES Bank lender, in fact, saw the retail loans by 3 percent in the fourth quarter of 2015, compared to a growth of 16 percent seen in Q4Fy24. The lenders with a high credit deposit ratio also chose to delay the rhythm of their general loan growth.

Posted on April 27, 2025