Money from the successful or manual trade stock market, global economy, merchant investor, graphic money of the block chain sale and purchase of cryptocurrency cryptocurrencies with graphic data graphic graphic data Istock Photo for bl | Photo credit: Thitima Uthaibom

The previous week, the 10 -year bonds of the United States. UU. They testified the worst week since 2001, and the yields increased 50 basic points during the week to 4.5 percent. Thought yields cooled during the past week, a new drama appeared with a dispute between President Trump and Fed Powell president.

Although the Trump administration is determined to reduce the yields of the long -term links, the preference of the Fed for waiting and observing the risks upward with led by the rate for inflation is to touch a brick wall. Last week, Trump said he could not wait for Powell’s office to declare, while at the same time Powell’s presidency is legally well expelled. The dead point is a classic case of when unstoppable force is with an immovable object.

The ‘elephant in the room’ here is the huge debt battery of the United States government of $ 36.2 billion. The country has been in an expenditure spree from the global financial crisis, which accelerated when the Covid pandemic hit.

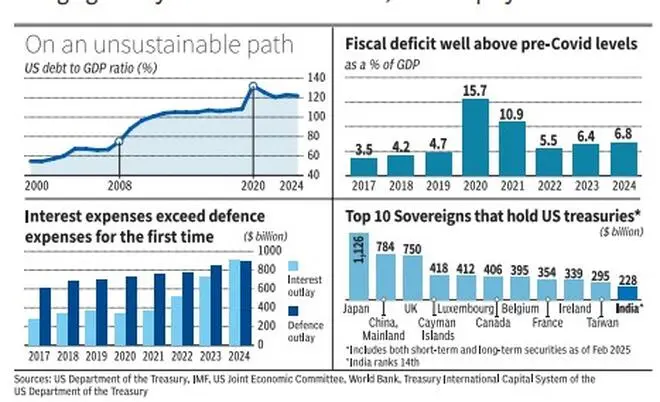

Today, the United States debt with GDP is significantly 122 percent (December 2024). Bondas yields may burn a hole through federal government finances, thus explaining Trump’s fixation and administration in bond yields. In fact, it was the tantrum of the previous week that pushed Trump to go quickly in reciprocal rates.

Three factors

The problems related to debt for the voice of the Trump administration of three factors.

First is the refinancing problem. The previous administration reduced the interest rate pressure by issuing short -term invoices instead of long -term bonds. While the approach was unsustainable for a long time, it is the problem of the current administration now refinance them with long -term bonds and add more pressure on yields.

Two, is the issue of the United States government addiction to spending, which, of course, Trump is trying to address Doge. While the US fiscal deficit. Uu. It cooled to 5.5 percent of GDP in 2022 (calendar year) after shooting 15.7 percent of GDP in 2020 due to the Covid stimulus, the ratio has now returned to 6.8 percent. Worse, the disbursement of interest of the federal government by 2024 exceeded the disbursement of national defense for the first time in the history of the nation. This reminds Ferguson’s law: “Any great power that spends more in the debt service than in defense, runs the risk of ceasing to be a great power.”

The third factor is a self -inflicted. The Trump administration policy, what to go and vision, tries to pour global supply chains and could Ty the safe state of the United States Treasury values and the global reserve currency status of the dollar. This is where the commercial war explodes in the capital wars. Altheghie There is still no solid alternative to the US dollar, global central banks could resort to other coins or gold even more. A week ago, speculations abounded in the bond market that China could retaliate by getting rid of their US bond holdings. This was one of the key reasons for the performance to increase the week before the last one, although the exact reason of the tantrum is still being investigated.

American debt, a capital disaster

Decades before, Richard Nixon’s secretary said famous: “The dollar is our currency, but it is his problem.”

Similarly, this US debt battery and high yields are not only a problem for the US, but one for capital investors worldwide. First, the policies that the Trump administration is trying to implement could result in a stagflation in the United States, a period of recession driven by inflated prices.

The main investment bankers have predicted a 50 percent/60 percent probability of a recession. In a globalized economic environment, this means a slowdown in global GDP. This combined with high bond yields in the United States, used as a reference point for price risk assets worldwide, can be a double blow to capital investors.

Investors around the world, even in India, must monitor the United States bond market.

Posted on April 19, 2025