The famous Short Seller Jim Chanos, who was one of the first people to call fraudulent accounting in Mega Scams such as Enron and Wirecard, described the current period as the ‘Golden Age of fraud’. In his opinion, an easy combination of money, weak regulatory supervisions and unprecedented speculative frenzy with a focus on short -term gains instead of the long -term have created a perfect platform for Ponzi schemes.

With regard to Indian investors, the approach is now in the risks of fraud in the system after the Gensol engineering fiasco collapsed last week. After the accusations of diversion of funds, Sebi prohibited the promoters of Gensol, the Jaggi brothers, of the stock market. The action continued its free fall and has dropped 90 percent since its maximum of 52 weeks.

The attention of investors has now returned to how accounting frauds can be detected. In the case of Gensol, although with the benefit of the retrospect, it is easy to identify the red flags now, it is important to have a structure and a method for analysis to detect the potential risks in advance and stay safe with their money analyzed.

In our Bachelor of Law. briefcase Edition dated March 2, 2025, we had explained how Beneish M-Score helps idelify companies that fuse their numbers. While not without limitations and prone to occasional false signals, this tool remains very useful for guiding investment decisions, especially in times of uncertainty. Its effectiveness as a detection mechanism is well recognized. For example, the students of the University of Cornell identified Enron as an accounting manipulator in 1998, three years before the giant fraud was unbelievable and the company declared bankruptcy.

So, we tried this to see if investors could apply this to gensol and remain away from the company before the mischief. The result we obtained was a resounding yes!

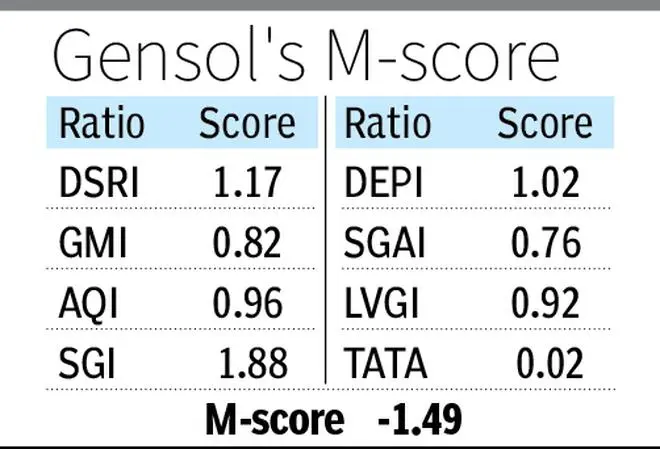

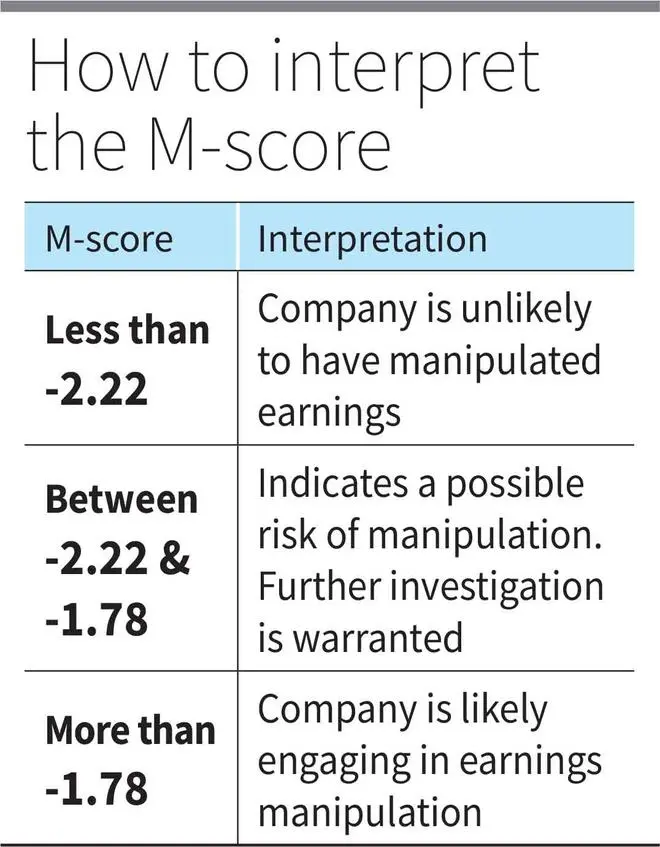

According to this tool, if the M score is greater than -1.78, it means that a company is probably dedicated to the manipulation of its profits. And Gensol scored -1.49 here. We have used the latest information for use of Gensol (Q3 Fy25 or Q2 Fy25, as appropriate). Applying this would have caused investors to further or leave the shares before the explosion.

Here is a summary of the score and how he went to Gensol.

M-SCORE AND GENSOL ENGINEERING

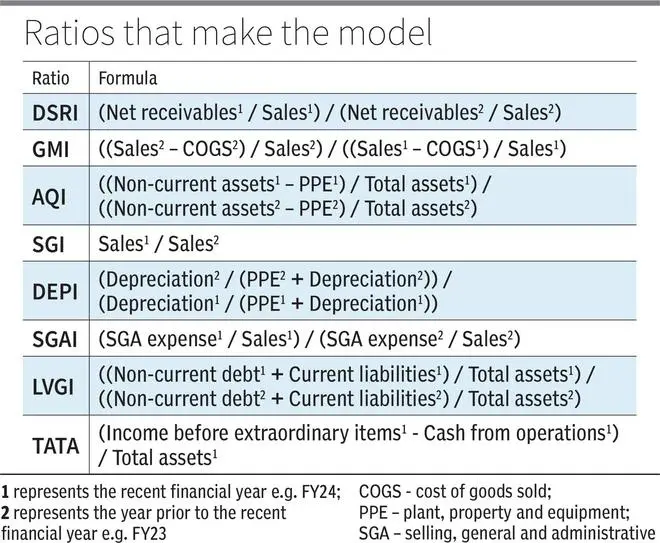

The M-Score methodology was devised in a research work by Messod D. Beneish, accounting professor at the Kelley Business School of Indiana University. He propiled a sample of companies that had been involved in profit manipulations and studied their distinction characteristics. Then it reached an equation/ formula that establishes a relationship between certain accounting relationships and the probability of gain manipulation.

M -Score = -4.84 + 0.92 dsri + 0.528 GMI + 0.404 AQI + 0.892 SGI + 0.115 DEPI -0.172 SGAI -0.327 LVGI + 4.679 TATA

The breakdown

DSRI

The sales of the days of GENSOL in the index of accounts receivable (DSRI) were 1.17, which indicates that although the income increased, they did not turn into cash at the same pace, resulted in an increase in accounts receivable. The days of accounts receivable increased from 49 days in the fiscal year 200 to 57 days in the fiscal year24, which means that a good part of the reserved income in the fiscal year24 was still like accounts receivable.

Companies can be lax in credit policy to inflate sales figures or even reserve fictitious sales, delay cash flow and affect liquuidity and a relationship approximately 1 suggests that artificial could be promoted. And here, the consequence of a slower cash conversion was also observed in the company’s operational cash flows, which will be discussed under the Tata index.

GMI

Gensol is an EPC player, the gross margin index (GMI) does not have much relevance. But when reading it as it is, the company’s GMI score was 0.82, which means that there was pressure on gross margins even when sales doubled in the last 12 months.

Aqi

This is where gensol cannot turn available loans from IREDA and PFC to buy electric vehicles (EV) into properties, plants and equipment (PPE), they are marked.

Notable, Gensol corrected a classification with respect to the leases, the duration Q2 Fy25, and recognized existing contracts as financial lease. This essentially transferred the EV fleet leased to its transport business (extinguishing Mart) from the PPE of Gensol to its financial assets (not common). Making a comparable adjustment for it, AQI stood at 0.96, losing the trigger (more than 1 indicates manipulation) only for a mustache.

However, never, with the benefit of the retrospective, the progress of capital still pending as advances for more than 12 months and an increase in the loans pending the related parties, not to mention the series of loans granted and received (from there and back) as the last two last.

SGI

Gensol showed an exponential growth in income from the 2010 fiscal year, with a growth of the CAGR to fiscal year 2005 to 85 percent, explaining a high sales growth rate (SGI) or 1.88 times. And with an order book of around ₹ 7000 million rupees from the third quarter of fiscal year 2015, it was projected that the company continued the exponential growth route. Their income, Ebitda and PAT registered a duration of 9 m for fiscal year 2015 had already exceeded their FY24 numbers.

The pressure to offer growth, for benefit, can lead to little ethical accounting practices, including earnings manipulation and, in this case, it seems that it did.

Depi

While the Depreciation Index (DEPI) is 1.02 for Gensol, the company transferred a part of its PPE (which was commercial vehicles) to other financial assets (not common) Pooring Q2 Fy25.

Companies could manipulate such estimates to reduce the position of depiction, thoroughing accounting profits. And here, the reclassification limited the interpretation here and is insigned.

SGAI

GENSOL Sales, General and Administrative Expenses increased by half of the rhythm, from their sales, carrying the index of sales administration, general, (SGAI) to 0.76, which suggests manipulation. And in terms of money, it is more questionable. The income obtained the last 12 months were ₹ 1,385 million rupees, 88 percent year after year of ₹ 735 million rupees, compared to SGA existence only ₹ 123 million rupees, 42 percent more than ₹ 87 million rupees.

LVGI

While manipulators choose capital over debt to raise funds, to avoid inviting the scrutiny of lenders and credit rating agencies, curiously, Gensol chose the debt on capital until fiscal year 200 and its leverage 1 time, only 1 time was 0.92.

The size of the general balance rises 1.2x, in ₹ ₹ 1,262 million rupees to ₹ 2,327 million rupees or March 2024 since March 2023. While capital contributed to only 8 percent of this, a new debt available from financial institutions, ₹ Duration FY24 (approximately 70 percent).

Although the capital infusion of around ₹ 220 million rupees was carried out after March 2024, the company first breached the service of its debt on December 31, 2024. What follows was a series of breaches, which remained under the documented documented documented documented history documented.

Tata

Total precision of total assets (Tata) calculates the difference between the accounting benefit of a company and operating cash flows, divided by total assets. The ability to convert accounting profits into cash gains reflects the true quality of profits. That is why in the calculation of intrinsic value, future cash profits are discarded. This relationship, weighted to 4,679, is crucial.

Gensol, with global working capital, easily failed this test with negative operating cash flows in the fiscal year24, which partially compensated for positive cash flows H1 Fy25 duration to drag the cash gains that fuenes the informed accounting profits.

The company reported negative operating cash flows in three of the last five fiscal years, which did not help the case.

After all, ultimately, it reaches “care with investors.” Therefore, the execution of projectors such as score M should not be a unique check, but a periodic review.

Posted on April 19, 2025