According to the reports, extremely high volumes of transaction status API, hardware problems and maintenance update for UPI interruptions that occurred during the last month are being given. | Photo credit: Jadampropor

An analysis of the transaction failures of the Unified Payment Interface (UPI) shows that among the large banks, the State Bank of India had the greatest number of transactions failures in the 2000 fiscal year, while the Bank of Baroda, HDFC Bank, Icici Bank had the counter.

The failures of UPI transactions occur in banks due to two reasons, i) Commercial Declace (BD) in which a user enters an invalid pin, an incorrect beneficiary account, etc. and ii) Technical Declace (TD) where the transaction decreases due to technical reasons, such as the lack of availability of systems and problems of banking or national networks of national payments of India (NPCI).

Technical decrease

SBI, which is the largest Bank of UPI senders with more than 4.95 billion transactions in March Solo, had a TD or 0.90 percent rate, while the second largest bank or Baroda of the largest public sector had a TD or 0.03 percent rate.

Meanwhile, HDFC Bank (with 1.5 billion transactions) had a TD or 0.02 percent rate, while Axis Bank had a TD or 0.03 percent rate and Icici Bank had a TD or 0.13 percent rate in March.Similar trends were observed in most months in fiscal year 2015. In March 2025, the main banks that reported higher TD rates were Bandhan Bank with 2.48 percent, and Jio Payments Bank with TD rate of 7.23 percent.

Why do transactions fail?

During the last month, there are multiple times of unchanged inactivity multiple bones that result in UPI interruptions. NPCI is the governing body of UPI and it is understood that it has with the bankers and players of the payment ecosystem this week to deliberate on ways of preventing such interruptions, which causes a great inconvenience to customers.

According to reports, extremely high volumes of transaction status API calls, hardware problems and maintenance updates for UPI interruptions that occurred during the last month are cited.

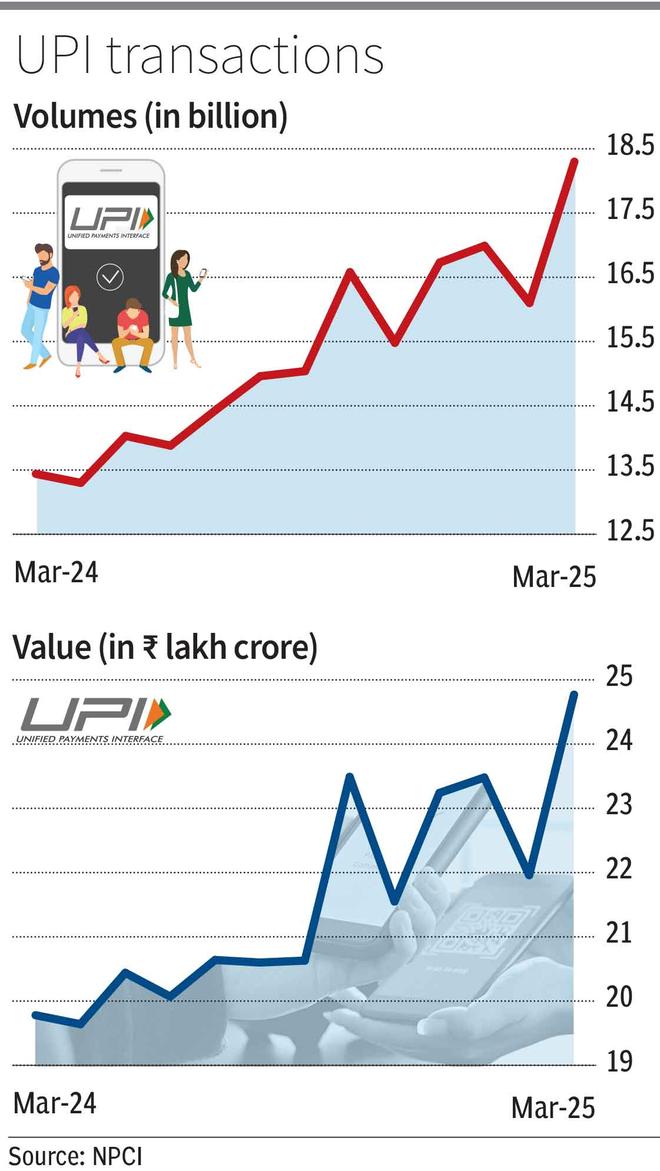

According to a great Executive of the Payment Company, previously the NPCI had informally asked the lenders to keep TD rates below 1 percent. However, currently with the rapid increase in UPI transactions, even having 1 percent reference of TD causes great inconvenience to customers. Sudden increase in the appropriate events of the duration of the UPI transaction such as IPL, large billions of days (due to online purchasing applications), also add to the tension on bank servers.

“Most banks are now moving around 0.1-0.02 per center, since it is estimated that UPI transactions grow from 18 billion to 30 billion. Banks must climb the infrastructure of the increase in transactions.” ”

To reduce transaction failures, experts say that payments ecosystem players must develop the ability to predict the growth of advanced transactions, improve their transactions system and perform hygiene controls of their servers, finally in a basic and anyway.

Kiran Hejmadi, Senior Product Management VP, FSS, shared similar views, indicating the importance of continuously investing in strengthening infrastructure resistance, improving system scalability and implementing proactive transactions monitoring frames.

Digital payments

“From a technical point of view, the implementation of native cloud and scalable payment platforms with real -time load balance and error switching capabilities can significantly mitigate the risks of transaction failures, especially the maximum periods,” said Hejmadi.

“In addition, the differential management of financial and non -financial transaction will also help the ecosystem. The payment industry has advanced notable to improve the activity time and the success rates of transactions over the years, and such in the Dárogos de Ongther are crucial infrastructure,” he added.

More like this

Posted on April 17, 2025