Despite the world’s economic uncertainties, three of the TI companies in India reported a sequential increase of 15 percent in the total value of the contracts won in the fourth quarter or fiscal year 2000, although largely led by agreements in the category of $ 1-5 million. This is the second quarter when companies have incessant the profits of agreements based on narrower offers, according to the data.

According to Grayhound’s investigation, the growing prevalence of $ 1–5 million offers reflects the uncertainty deeply rooted in customer joint rooms, partly as the provision of rhetoric services and regulators of the US rate. UU.

“Fy26 Will Be Marked by” Selective Wins, “Not Sweeping Growth-Clients Are Segmenting Large Transformation Program Smo Bite-Sdized, Milestone-Driven Contracts That Can Be Paused Or Refactored Quickly If The External Alsid, and the New Goldality and The New Gold The New Goldality, and The New Goldality, and the New Goldality, and The New Goldality, and the New Goldality, and the New Goldality, and The New Goldality, and the New Goldality and the new Goldality and Butard, and the new Goldality, and the new Goldality, and the new Gold.

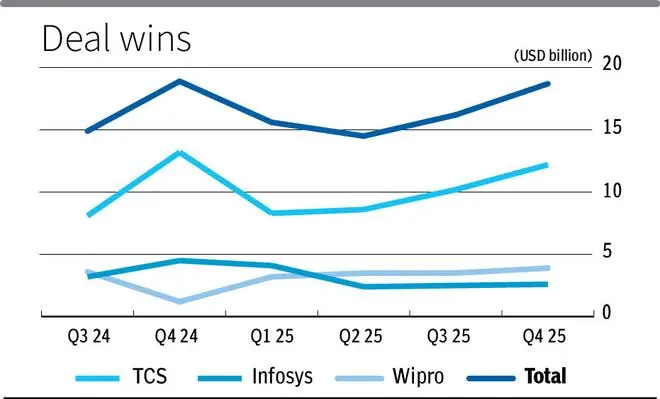

Tata Consultancy Services (TCS), Infosys and Wipro together reported profits worth $ 18.7 billion in the fourth quarter, compared to $ 16.2 billion reported in the third quarter, with TCS that represent most of the victories at $ 12.2 billion. It should be noted that in a basic annual size of the agreement for the three companies decreased marginally by 1 percent, since both TCS and Infosys had done it particularly well in the fourth quarter or fiscal year 2024.

“Our Q4 TCV record (total contract value) or $ 12.2 billion demonstrates our ability to gain market share. North America TCV reached a historical maximum of $ 6.8 BFSI TCV was $ 4 billion. The absence of mega agreements,” said K Krithivasan, CEO of TCS.

Small offers lead the victory

In general, the customer base of one million dollars for the three companions increased by 32.5 percent of 2,294 in the quarter of the customer last year to 3,040 in the quarter of this year, while at $ 10 million, $ 50 million and $ million.

TCS added 38 new customers to its base of one million dollars and 2 new customers at its base of 100 million dollars. In general, the client’s contribution grew for TCS, except for the 50 million dollars, where the number reduced by 9 customers.

Infosys reported 33 new clients of one million dollars and 2 new customers of 50 million dollars. It is a great offer, TCV stood at $ 2.6 billion compared to $ 2.5 billion in the third quarter, 4 percent more sequential. For fiscal year25, Deal TCV stood at $ 11.6 billion.

Speaking about the performance of Infosys, Motilal Oswal Financial Services said: “Approximately two thirds of the decrease in income was due to lower third -party costs and income, since some agreements left the quarter.

Good room for Wipro

Wipro reported a low number of earlier and annual agreements, but in terms of treatment size, the company improved both dryly and annually. In addition, large TCV offers increased by around 83 percent to $ 1,763 million with total reserves or $ 3,955 million. The Company Also Won Two Mega Deals This Year: A Five-Year Deal To Deliver Ai-Powered End-To-End It Services Across 200 Countries and a partnership with a Global Food Food Taking Taking About It It Infrastructure and Corporate, and Corporate, and Corporate, and Corporate, and Corporate, and Corporate, and Corporate, and Corporate Corporate, and Corporate, and Corporate, and Corporate, and Corporate, and Corporate, and Corporate, and Corporate, and Corporate, Corporate, Corporate, Corporate, and Corporate, and Corporate, Corporate, Corporate, Corporate, Corporate, Corporate, Corporate, Corporate, Corporate, Corporate, Corporate, Corporate, Corporate, Corporate, Corporate, Corporate, Corporate, Corporate, Corporate, Corporate, and Corporate and Corporate

Noting that the company closed 17 large offers of $ 1.8 billion in the fourth quarter and 63 large offers of $ 5.4 billion in fiscal year 2015, Nuvama Research said that the large offers for signed Wipro will take time to increase, which leads to lower short -term income. The income conversion agreement is lower, since you also see a cut in discretionary spending and delay in some projects. The general pipe is strong with a decent contribution of a large and small agreement.

“Given the uncertainty in the environment, management expects customers to adopt a more measured approach to spend discreet expenses. Beer Beer Beer Beer Beior Beior Beior Beior Beior Beior Beior Beior Beior Beior Beior Beior Beior.

America shows low performance for TCS and Infosys

The income regarding North America showed an annual decrease for TCS and Infosys. For TCS, North’s income fell 1.9 percent in an annual basic, while India showed the high to 33 percent followed by regions of the Middle East and African with 13.2 percent. United Kingdom and Continental Europe grew by 1.2 percent and 1.4 percent respectively.

“Europe with a growth of 1 percent of Qoq Usd, served well in the back of large victories in Q3Fy25. America showed a performance off with a qoq growth of -0.2 percent. Middle East and Africa grew well,” said Icici Securities on Ittste.

In the case of Infosys, the revenues of the North American market fell 0.8 percent, while that of the Indian market grew by 39 percent. Rest of the world, income fell 4.5 percent annually for Infosys. According to Motilal Oswal, the automotive sector of Europe has experienced some softness. The company’s average grew three times, backed by an extraction of customers from customers and large offers.

Wipro showed an interesting deviation from the geographical trend, which reports a more prominent degradation in Europe with 8.3 percent, followed by a decrease in the Eastern Asian and Middles regions and African at 7.3 percent and 2.7 degraded

“If you observe our income for last year at a full year base, the Americas have grown 1.2 percent real and it is Europe that has shown degradation. In fact, Apmea had a degradation, but in the fourth quarter, in Europe, we have a large amount of a big problem, Phoenix Group, which will begin to begin in a few months now from the terms of contract.

According to Grayhound’s investigation, rebalancing to Europe is no longer optional. With the US market mired in tariff tension and regulatory overhang (EC, continuous discrimination probes), IT companies must diversify the risk by expanding their European operations and emerging markets. Europe, particularly the DACH, the Nordics and the United Kingdom, is seeing a constant demand for sectorial infrastructure of clouds, Genai and Digital, which offers a stabilization effect for suppliers that face winds against the Americas.

Posted on April 20, 2025