After three years of robust growth, the infrastructure space saw that the traction slowed over the past year or so.

A combination of multiple parliamentary elections and assemblies over the last 12 months and the underestimation of the Government of Budget Expenditure related to infrastructure The last prosecutor has resulted in prizes of slower projects and delayed payments.

However, for fiscal year 26, the Government has indicated an increase of more than 10 percent in capital expenses (₹ 11.21 Lakh Crore) of the fy25 reviewed estimates. The contracts are returning to the current and attacked payments are being launched.

In addition, the subsidy to create capital assets, to ₹ 4.3 Lakh million rupees and others ₹ 4.3 Lakh million rupees in Capex spends for public sector companies, both for fiscal year 26, present considerable opportunities for companies operating in space.

We had recruited buying NCC shares in December 2023, since it is a key beneficiary of the thrust in the expansion of capital expenses.

From our price with the margin (₹ 167), the action doubled with more of the duplication to the levels of ₹ 357 and from there it was reduced to half in the market butcher shop (₹ 175) witnessed in the spaces of medium and small capitalization during the period from September 2024 to March 2025. It has been subcratally recovered around ₹ 210 currently.

We reiterate our ‘purchase’ recommendation to the current market price from a perspective of two to years.

A ₹ 217.85, the shares are traded 13.5 times their probable profits per action for fiscal year 2016, which makes reasonably attractive assessments.

NCC operates in segments classified from buildings and homes, roads, water and environment, to irrigation, electrical works, mining and railways. These projects are executed for several state and central government entities, separated from some private groups.

A solid execution history, diversified orders book and a lucrative project pipe to work in the coming years make the perspectives for the NCC stock attractive.

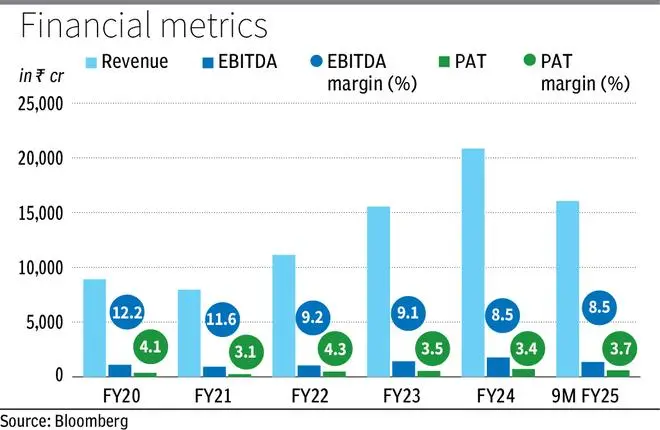

In 9MFy25, company’s revenues grew by 11.9 percent year after year to ₹ 16,068 million rupees, while net earnings increased by 20.2 percent to ₹ 566 million rupees.

Reliable record

NCC operates in multiple segments of the infrastructure issue, as mentioned above.

Industrial and commercial buildings, IT parks, shopping centers, schools, hospitals, meters, roads, water treatment plants, underground drainage, electrification, transmission and distribution lines and substations, dams, reservoirs, tunnels, track placement, signage and excavation of coal are some of their areas of experience.

Its customer list includes BMC, Chennai Metro Rail, Indian Oil, Adani Group, Nhai, Rvnl, ESIC, Pune Metro, Namma Metro, India Coal and Author of the Airport Authority of India. The departments or about 13 states are part of the NCCS client base.

A sample of projects he executed includes Nagpur Rail, ESIC hospital in Gulbarga, Aiims Guwahati, Agra-Luck Express Way, Svab, Isro Sriharikota, Water supply project in Odisha, rubber airport, airport, airport, airport.

The great continuous projects include orders for smart meters and contracts of the Jal Jeevan mission.

Order-book

Custom or in December 2024, NCC had an order book of ₹ 55,548 million rupees to be executed in the coming years. The order book translates into around 2.45 times its final income of 12 months.

Being an EPC player (engineering, acquisition and construction) with a long history, the company can offer optimally for its projects and generally has capable of maintaining the decent Ebitda margins.

In fiscal year24/25, the margin has decreased a bit due to the slower project awards and delayed payments of government clients. However, in the next quarters, most of these payments are likely to be made.

This margin is still healthy given the scale to which it operates. It is also increasingly prohibited in projects that contain climbing clauses to isolate the company with the increase in input prices.

The company has been able to constantly take advantage of emerging areas and develop experience to win orders. Smart measurement is one of those areas, given the approach that many state electricity boards put on it to reduce income and stockings.

The current NCC order book is quite diversified with buildings (38 percent), transport (19 percent), electrical transmission and distribution (19 percent), water and railways (10 percent), irrigation (9 percent) and mining (5 percent) the main constituent.

Given the diversity of the order book and the criticality of many projects that it is executing, there is a reasonable visibility in gains and margins for the coming years.

Debt under control

NCC’s debt has increased in the last year, mainly due to the delay in payments and mobilization advances for most of the fiscal year 2015. Although the net debt is around ₹ 2,284 million rupees or in December 2024, the relationship of net to capital is still reasonable at 0.3. When payments arrive in the future and the project awards return to the two -digit growth phase, debt levels are expected to decrease around fiscal year 2016 and early fiscal year 2017.

Posted on April 19, 2025