On Thursday, Bitcoin prices (BTC) fell to less than $ 101,000 as consequences between the president of the United States, Donald Trump, and the richest man in the world, Elon Musk, shook the financial markets of the United States. However, in the last 48 hours, the opening cryptocurrency has registered a rebound that rises to more than $ 105,000 before falling into a lateral movement. In the midst of developments, a popular cryptographic analyst with X pseudonym Killaxbt has outlined multiple scenarios for the next Bitcoin price action.

Beitcoin’s rebound of $ 100,000

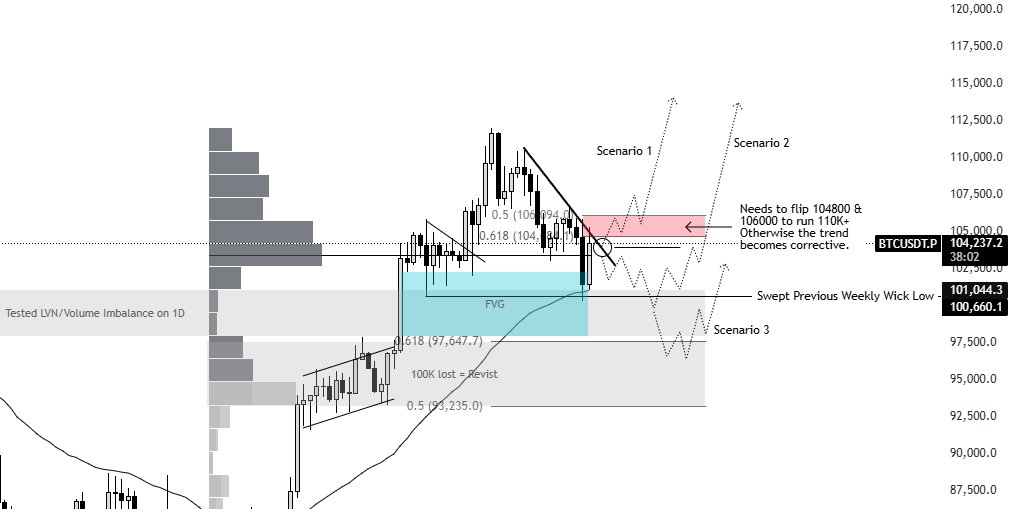

In a unknown On June 7, Killaxbt provides a deep technical analysis of the Bitcoin market that discusses the recent price rebound and potential developments in the future. After reaching a new historical maximum about $ 112,000 on May 22, BTC entered a corrective phase that fell by 10% estimated in the price range of $ 100,000, before its recent rebound in the last two days.

Killaxbt explains that this rebound is not random and was driven by a combination of technical and market factors. These factors include the daily imbalances of FVG and the volume that are inefficiencies full of prices that remain in the table.

In addition, there was a sweeping of liquidity since Bitcoin’s constant decline pushed prices below the minimum previous weekly that caused many falls in the long positions. This development created a liquidity discharge for the great players that served as fuel to boost a market rebound.

Finally, Killaxbt talks about a brief Wasby compression configuration, the Bitcoin market became short when merchants expected an additional disadvantage after the initial price of $ 100,000. When prices began to rise, these short merchants had to buy again to cover their losses, adding more fuel to the rally.

What’s still for BTC?

Looking towards the future, Killaxbt has highlighted three potential scenarios for BTC. Currently, analysts establish that the main cryptocurrency is re-testing a resistance zone between $ 104,800- $ 106,000, which is aligned with the fibonacci setback levels 0.5-0.618 of the recent price drop.

For the first scenario, Killaxbt presents a bullish continuation only if Bitcoin breaks and remains above this resistance region. Such movement could catch short sellers once again, potentially feeding a more upward impulse.

However, if Bitcoin faces rejection in this area of specific resistance, the second scenario comes into play, in which the price is likely to decrease and re -test the support level of $ 100,000. The third scenario, final and in the worst case includes a price break below the $ 100,000 Bitcoin leader to test support areas around the price region of $ 97,000.

Interestingly, Killaxbt’s personal projection expects market manufacturers to continue driving the highest bitcoin price, taking advantage of the recent acute rebound that many short merchants were expelled. Without long -lasting “safe” AV sheet, however, the analyst suggests that pushing prices even more to the best -selling trap while forcing lateral bulls to pursue the rally

At the time of publication, BTC continues to operate at $ 105,600, reflecting a gain of 1.16% on the last day.

Istock’s prominent image, TrainingView graphics

Editorial process For Bitcoinist, he focuses on the delivery of content completely investigated, precise and impartial. We maintain strict supply standards, and each page undergoes a diligent review of our technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.