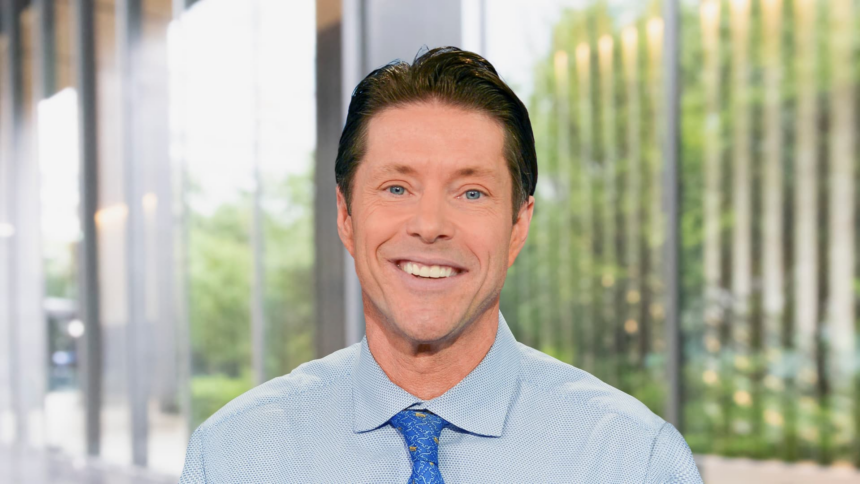

The “fast money” merchant, Tim Seymour, wants to help investors to avoid common money traps that could leave them exposed to losses, spectularly in a volatile market.

He is out with a list of four tips to offer some tranquility when things go south.

Tip No. 1: Do not have more money in the market than you can bear.

Whether they are margin calls or anxiety to lose money that cannot afford to lose, bad decisions often despair.

Tip No. 2: I don’t hope you return to Breakeven.

If you are only occupying a long position because you do not want to live money in trade, you run the risk of losing more.

In a nutshell: possess an action based on merit, not hope.

Tip No. 3: Do not assume that yesterday’s investment justification will work tomorrow.

Ask yourself: “Has something changed in the fundamental case or is it a case of market volatility?” If something changed, make adjustments.

Tip No. 4: Do not cut the flowers and keep your weeds.

Often, the highest quality companies will exceed a down market. Bad position? Back to No. 2.

To obtain more personalized investment strategies, join us for our next live “Fast Money” event on Thursday, June 5 at Nasdaq in Times Square.