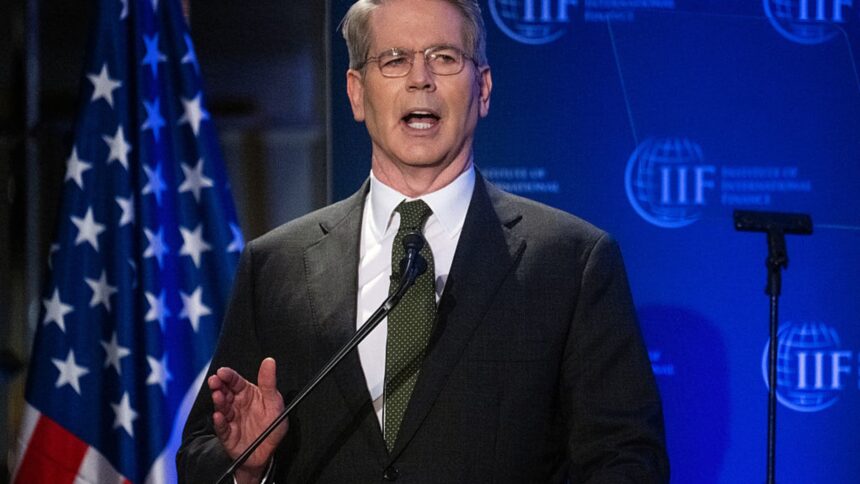

The United States Secretary of the United States, Scott Besent, speaks during the Perspective Forum of the International Finance Institute (IIF) in Washington, DC, on April 23, 2025.

Jim Watson | AFP | Getty images

The secretary of the Treasury, Scott Besent, said on Wednesday “there is a chance for a big problem here” about commercial problems between the United States and China.

“If you want to rebalance, let’s do it together,” Besent said during an appearance at the International Finance Institute in Washington, DC

“This is an incredible opportunity. I think that if Bridgewater’s founder, Ray Dalio, wrote something, could call him a beautiful rebalancing.”

Dalio, on April 13, told NBC News that he was worried that the economic and economic rates of President Donald Trump threaten the world’s economy, potentially to the point of “something used than a recreation.”

Trump has imposed ultra high tariffs on China, or 145%. Shortly before Besent spoke on Wednesday, the Wall Street Journal reported that the Trump administration was considering reducing those rates to between 50% and 65%, which would still be extremely high, relatively speaking.

Besent, in his direction to the IIF, described what he called “a plan to restore balance to the global financial system and the institutions designed to defend it,” specifically the World Bank and the International Monetary Fund.

“The IMF and the World Bank have a lasting value,” Besent said. “But Mission Creep has eliminated these institutions. We must promulgate key reforms to ensure that Bretton Woods institutions are serving their interested parties, not vice versa.”

He said that “intentional policy options by other countries have fled the United States manufacturing sector and have undermined our critical supply chains, putting our national and economic security at risk.

“President Trump has taken strong measures to address these imbalances and the negative impacts they have on Americans.

“This status quo of large and persistent imbalances is not sustainable. It is not sustainable for the United States and, ultimately, is not sustainable for other economies.”

Besent called the World Bank for loans to nations that have advanced economic growth, including China.

He suggested that the bank stop lending to China.

“The World Bank continues to provide the countries they have with the criteria of graduating from the loans of the World Bank,” Besent said.

“There is no justification for these continuous loans. Spusia The resources of high priorities and the crowds of the development of private markets. It also discourages the efforts of the countries to move to move from the private sector, the private sector and towards work and towards work and to work and to and to and to and towards the decline and towards the light and towards the light and towards.”

Besent added: “In the future, the bank must establish firm graduation deadlines for countries that have done so with the graduation criteria. Treating China, the second largest economy in the world, as a” developing country “is absurd.

“While it has a leg at the expense of many western markets, China’s rise has been fast and impressive,” he said. “If China wants to play a role in the global economy according to its real importance, then the country needs to graduate, we appreciate it.”

– CNBCS Doherty er Contributed to this story.

Correction: Besent spoke by making an appearance at the Institute of International Finance. An earlier version was lost the name of the organization.