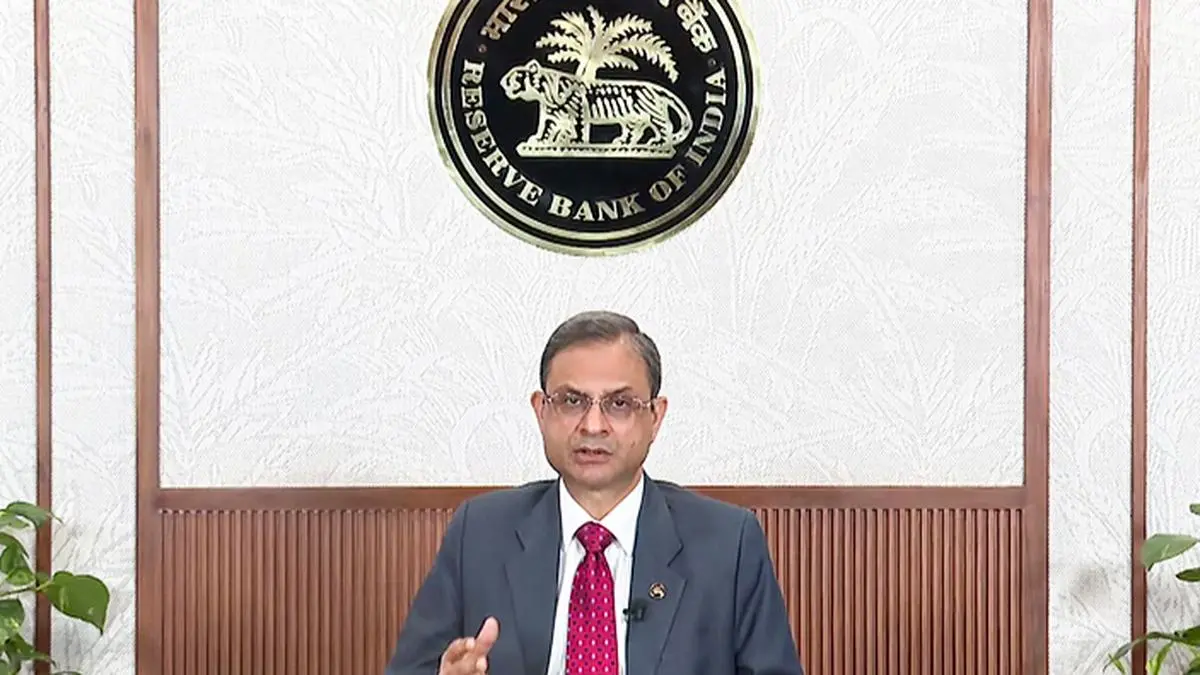

Governor of the Bank of the Reserve of India (RBI) Sanjay Malhotra | Photo credit: ANI

India’s call money market faces risks of reducing liquuidity, raising challenges for the transmission of monetary policies, said the head of the Central Bank of the country in a speech published on Saturday.

The governor of the Bank of the Reserve of India, Sanjay Malhotra, said Conern “asymmetries that sometimes arise between different monetary market rates, the rate to which RBI provides liquidness, the money rate of the call, the market repository rate and the TREPS.”

Banks – The Entities With Sole Access to The Rbi’s Liquuidity Facilities, The Call Money Market and the Repo Markets – Must Be Proactive To Reure That The Central Bank’s Liquuidity Measures are UplootataTaotaTaotaota, Malhotra, UplootataTataotaotaotaotaotot, to the RBI Website on Saturday.

The call money rate is an interest rate during the night to which banks and other financial institutions lend and borrow from each other. When the RBI reduces interest rates or inject liquidity, it can reduce the call money from the call, transmitting the central bank’s policy moves to the system.

The surplus liquefura in India has averaged 1.7 billion rupees ($ 20 billion) per day this month, reversing a four -month deficit, since the RBI intensified its liquuidity infusions to support growth.

The governor also asked to depend on the Market of Government Securities of India and improve liquuidity and prices by increasing the participation of various interested parties.

There is also a need for a more proactive management of risks by different stakeholders in the derivative market, improving the depth of the market, increasing the diversity of views and the ghost of greater competition and efficiency, he said ($ 1 = ₹ 85,4290).

Posted on April 19, 2025